One of Nvidia’s (NVDA) directors, Mark A. Stevens, has been on a selling spree, offloading shares of the company worth $40.7 million so far in October. It’s reasonable to assume that Stevens, a well-known venture capitalist, is taking advantage of the significant surge in NVDA stock price driven by the artificial intelligence (AI) boom. Year-to-date, shares of the company have surged over 172%.

Nvidia designs and manufactures advanced graphics processing units (GPUs) and AI computing technology. For a thorough assessment of the stock, go to TipRanks’ Stock Analysis page.

Closer Look at the Insider’s Transactions

According to the most recent SEC filing, Stevens divested 155,000 shares of NVDA on October 9, with prices ranging from $132.00 to $132.75 per share. The total value of the transaction was $20.5 million. Before this, he reported selling NVDA stock valued at $4.84 million on October 1 and $15.32 million on October 7.

Interestingly, Stevens has been selling the company’s shares almost every month since November 2023, with the exception of August this year. Despite these transactions, he still holds 38.27 million Nvidia shares valued at approximately $5.16 billion.

It’s important to highlight that Nvidia’s significant stock price increase has also benefited its other key executives. CEO Jensen Huang, who has the largest individual stake in Nvidia, cashed out $713 million from the stock sale this year through his Rule 10b5-1 trading plan.

Insiders Sentiment for NVDA Stock Is Currently Negative

Overall, corporate insiders have sold the company’s shares worth $80.9 million over the last three months. Overall, the sentiment among corporate insiders is currently Negative.

However, this doesn’t necessarily signal trouble for the company. Given Nvidia’s impressive growth and the increasing adoption of AI technologies, these insider transactions may not be a cause for concern.

Investors may benefit from keeping an eye on transactions made by key insiders, as these trades typically reflect their trust in the company’s future. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Nvidia a Good Stock to Buy Now?

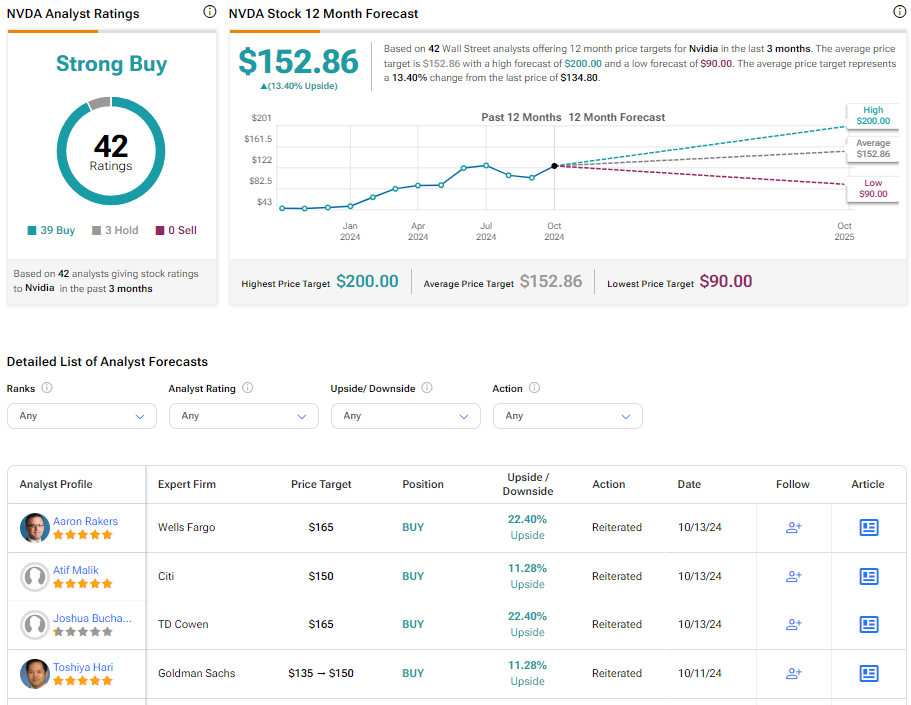

Turning to Wall Street, NVDA has a Strong Buy consensus rating based on 39 Buys and three Holds assigned in the last three months. At $152.86, the average Nvidia price target implies 13.4% upside potential.