Energy Transfer’s (ET) Executive Chairman Kelcy L. Warren recently bought the company’s shares worth around $47 million. ET provides natural gas pipeline transportation and transmission services.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

According to the SEC filing, Warren bought 3 million shares of the company on August 12 at a weighted average price of $15.68 per share. Before this, he bought 600,000 shares of ET for $9.19 million in June 2024. Importantly, the total value of his holdings now stands at about $4.7 billion.

As per the data collected by TipRanks, Warren has had a 69% success rate in his 36 transactions over the past year, with an average 12% return per transaction.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Developments

It’s worth highlighting that Warren’s purchase of ET stock came after the company released its second-quarter results on August 8. In the reported quarter, sales increased by 13.2% year-over-year, and Q2 earnings jumped by an impressive 40%.

Looking ahead, Energy Transfer raised its full-year adjusted EBITDA outlook to a range of $15.3 billion to $15.5 billion, up from the previous guidance of $15.0 billion to $15.3 billion.

Is ET a Good Stock to Buy?

On TipRanks, ET commands a Strong Buy consensus rating based on eight Buys and one Hold. The analysts’ average price target on Energy Transfer stock of $19.63 implies 25.99% upside potential.

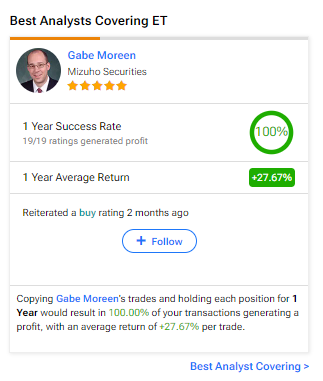

Investors looking to buy ET stock could follow its most accurate analyst on TipRanks, analyst Gabe Moreen of Mizuho Securities. Moreen has a track record of 100% success, with all 19 of his ratings on the stock having generated a profit over a one-year time frame. Replicating his trades for the said period could result in an average return of 27.67% per trade.