One of Eagle Bulk Shipping’s (NYSE:EGLE) more-than-10% owners, Castor Maritime Inc. (NASDAQ:CTRM), revealed a huge purchase of the company’s shares, worth $10.7 million. It should be noted that Castor Maritime is a shipping company engaged in the transportation of dry bulk cargoes.

As per the SEC filing, the insider bought 169,635 shares of EGLE between April 3 and April 4 at an average price of $62.81 per share. After the latest purchase, Castor Maritime owns 1.56 million shares of EGLE stock worth about $97.7 million.

Investors could keep close track of these notable insider activities, as they reflect the perception of key insiders about the company’s prospects. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Recent Update on EGLE Stock

It is worth highlighting that just after the insider purchased EGLE stock, the company’s shareholders approved its all-stock merger with Star Bulk Carriers (SBLK). The companies expect to close the transaction on April 9. Upon closing the new company will operate as Star Bulk Carriers Corp.

With the addition of Eagle Bulk’s impressive fleet, SBLK is expected to become a global leader in dry bulk shipping. Furthermore, the deal is expected to boost Star Bulk’s top-line performance. Perhaps the insider’s purchase reflects its confidence in the new company’s potential success.

Following the announcement of merger approval, Deutsche Bank analyst Amit Mehrotra raised the price target on Star Bulk to $34 (42.4% upside potential) from $24 and maintained a Buy rating on the stock.

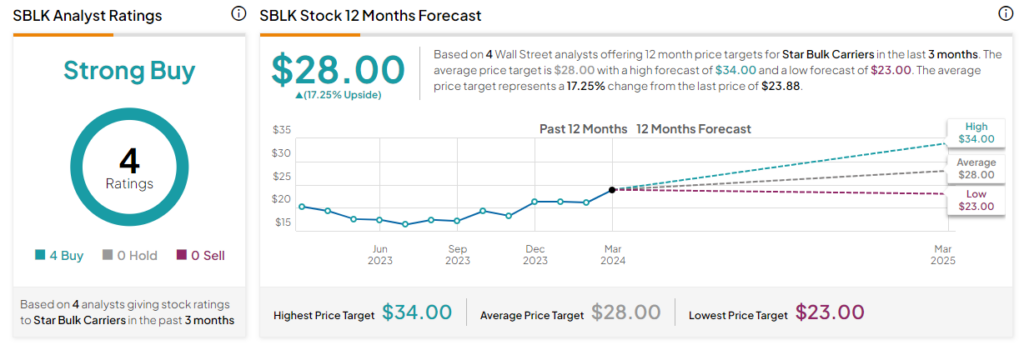

What Is the Forecast for SBLK Stock?

Overall, analysts have a Strong Buy consensus rating on Star Bulk based on four unanimous Buys assigned in the past three months. Furthermore, the analysts’ average price target on SBLK stock of $28 per share implies 17.3% upside potential. Shares of the company have gained about 15% over the past three months.