Ace investor Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) has once again purchased shares of the oil and gas giant Occidental Petroleum (NYSE:OXY). As per the SEC filing, Berkshire disclosed the purchase of 1.75 million shares of OXY in multiple transactions between June 5 and June 7, for a total value of $105.54 million.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

These purchases were made at prices ranging from $59.67 to $59.93. It should be highlighted that Berkshire bought these shares indirectly, through its subsidiary National Indemnity Company.

Importantly, Berkshire now owns 250.67 million shares of Occidental, worth $15.16 billion, based on Wednesday’s closing price. It also owns 84,897 shares of Occidental’s Series A Preferred stock and about 83.8 million warrants to buy OXY stock at $59.62 per share.

Bullish Insider Trading Signal

Overall, TipRanks’ Insider Trading Activity Tool shows that insider confidence in the stock is currently Positive. Corporate insiders have bought Occidental stock worth $259 million over the last three months.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

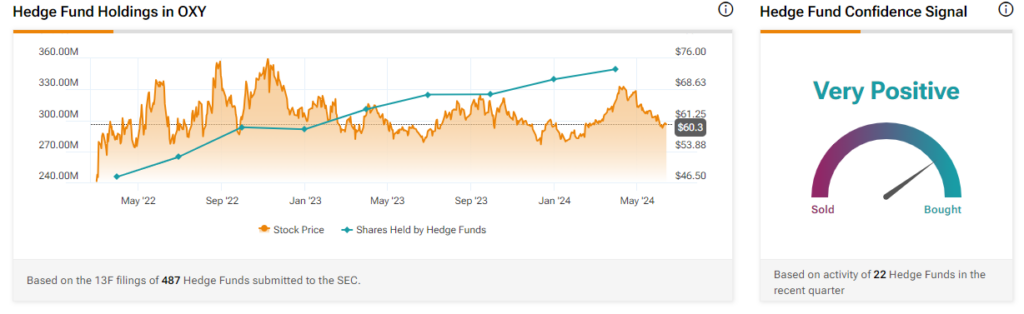

Hedge Funds Remain Optimistic

Occidental’s improving production and financial performance keep hedge fund managers bullish on the stock. Furthermore, the company’s $12 billion cash-and-stock acquisition of CrownRock is expected to increase production by 170,000 barrels per day. This expansion is likely to further bolster OXY’s performance in the near term.

Currently, the Hedge Fund signal remains Very Positive for Occidental stock. TipRanks data shows that hedge funds bought 9.8 million shares of the company last quarter.

What is the Future of OXY Stock?

OXY stock has a Hold consensus rating based on two Buys and eleven Holds. The analysts’ average price target on Occidental stock of $72.15 implies 19.7% upside potential from current levels. In the past six months, OXY shares have gained 6.2%.