Edward Lampert, a more-than-10% owner of AutoNation (AN), recently sold shares worth $10.36 million. A corporate insider’s share sale usually signals caution about the company’s future potential. However, an insider might sell shares for other reasons, such as financial or personal obligations.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts and uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

AutoNation is an American car retailer that connects buyers and sellers of both new and used cars. On July 31, AutoNation reported Q2 FY24 adjusted earnings of $3.99 per share, missing the consensus of $4.32 per share. Similarly, revenue of $6.48 billion came in lower than the Street’s estimates of $6.72 billion. Year-to-date, AN shares have gained 13.7%.

A Closer Look at the Insider’s Transactions

As per Form 4 filed with the SEC on August 2, Lampert sold 53,562 AN shares on July 31, at a weighted average price of $193.4499 apiece. It is worth noting that even after the latest Informative Sell transaction, Lampert still owns $653.22 million worth of AutoNation shares.

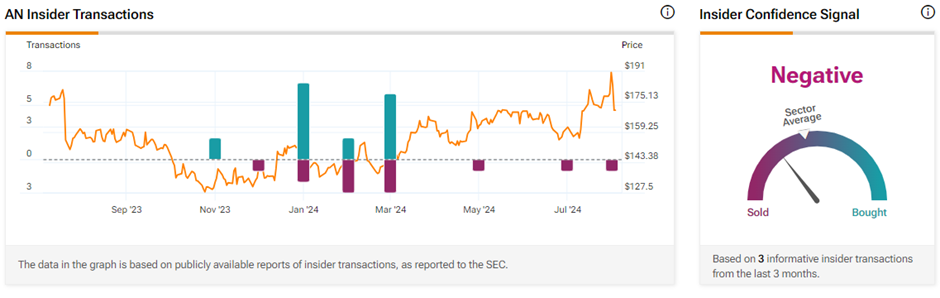

AutoNation stock currently has a Negative Insider Confidence Signal on TipRanks, based on Informative Sell transactions worth $32.3 million undertaken in the last three months.

It is important to keep an eye on the Informative trades of corporate insiders, given their knowledge of a company’s growth potential. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is AutoNation a Good Stock to Buy?

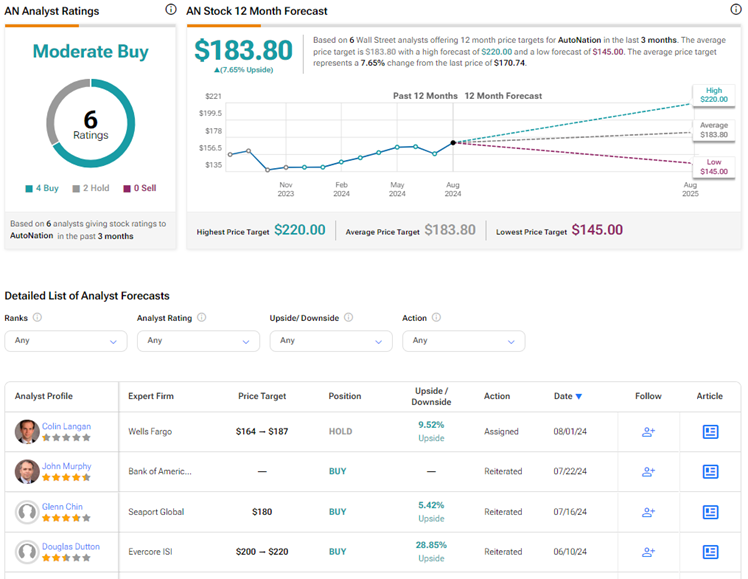

On TipRanks, AN stock has a Moderate Buy consensus rating based on four Buys and two Hold recommendations. The average AutoNation price target of $183.80 implies 7.7% upside potential from current levels.