DLH Holdings (NASDAQ:DLHC) is primarily a government contractor. The company engages in the provision of professional healthcare and social services to government agencies.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let us take a look at the company’s financials and understand what has changed in key risk factors that investors should know.

Q4 Financial Results

Sales increased 28.6% year-over-year to $65.2 million. Meanwhile, the company reported $0.21 per share in profits, up 110% year-over-year.

At the end of Q4, DLH had $24 million in cash and cash equivalents and $44.6 million in long-term debt obligations.

The company’s upcoming earnings report is expected to be released on February 9.

Risk Factors

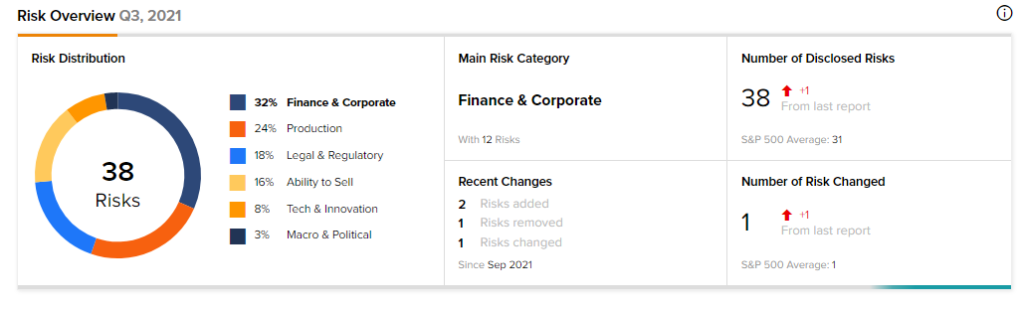

According to the new Tipranks Risk Factors tool, DLH’s main risk category is Finance & Corporate, which accounts for 32% of the total 38 risks identified. The next two major risks categories are Production and Legal & Regulatory, which stand at 24% and 18%, each.

The organization has added two new risks under the Legal & Regulatory category.

DLH points out that service contracts with the federal government account for nearly all of the company’s revenue. He warns investors that new regulations could restrict the government’s use of services from private contractors, which may have a detrimental impact on DLH’s operational performance.

Second, as DLH is a government contractor, its business lines are subject to a variety of regulations. As a result, if the corporation does not follow the regulations that regulate the industry, it may face fines, penalties, and other punishments. The company’s operating results, cash flow, and financial position might suffer as a result of these additional obligations.

Meanwhile, the Finance and Corporate risk factor’s sector average is 39.7%, compared to DLH Holdings’ 31.6%. The stock has gained 127.8% so far this year.

Wall Street’s Take

Turning to Wall Street, the stock has a Moderate Buy consensus rating based on 1 Buy. The average DLHC price target of $21 implies 1.1% downside potential to current levels.

Download the mobile app now, available on iOS and Android

Related News :

Sonoco Acquires American Recycling of Western North Carolina

Xeris Biopharma Bags FDA Approval for Recorlev; Shares Pop 30%

Designer Brands Updates 1 Key Risk Factor