Autotech solutions provider indie Semiconductor, Inc. (NASDAQ: INDI) has reported mixed results for the fourth quarter ended December 31, 2021, as revenues surpass but earnings miss estimates.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, following the results, shares of the company rose 5.7% to close at $8.10 in Tuesday’s extended trading session.

Revenue & Earnings

indie Semiconductor reported quarterly revenues of $19 million, up 185% from the same quarter last year. The figure also topped the consensus estimate of $18.26 million. A year-over-year increase of 163.6% in product revenues to $16.3 million was the primary contributor to the overall growth in revenues for the company.

However, a loss per share of $0.26 during the quarter came in wider than the consensus estimate of a loss per share of $0.09. The figure compares favorably with a loss of $2.01 per share reported in the year-ago quarter.

The company’s gross margin improved to 46.3%, compared to 35.4% last year.

Outlook

For the first quarter of 2022, the company forecasts revenue to hover between $21 million and $22 million, up 160% to 170% year-over-year. The gross margin for the same period is expected to be 47%.

CEO Comments

The CEO of indie Semiconductor, Donald McClymont, said, “Our outperformance reflects the strength of indie’s differentiated product portfolio coupled with crisp operational execution. At a higher level, indie is at the epicenter of several powerful automotive megatrends, including ADAS, connected car, user experience and electrification. Looking ahead, we believe our deeper investments and targeted acquisitions are setting the stage for accelerating growth in 2022 and positioning indie to become the leading provider of edge sensors spanning LiDAR, radar, ultrasound and vision applications.”

Stock Rating

Consensus among analysts is a Moderate Buy based on 2 unanimous Buys. The average indie Semiconductor stock prediction of $19.50 implies upside potential of 154.6% from current levels. Shares have declined 29.5% over the past year.

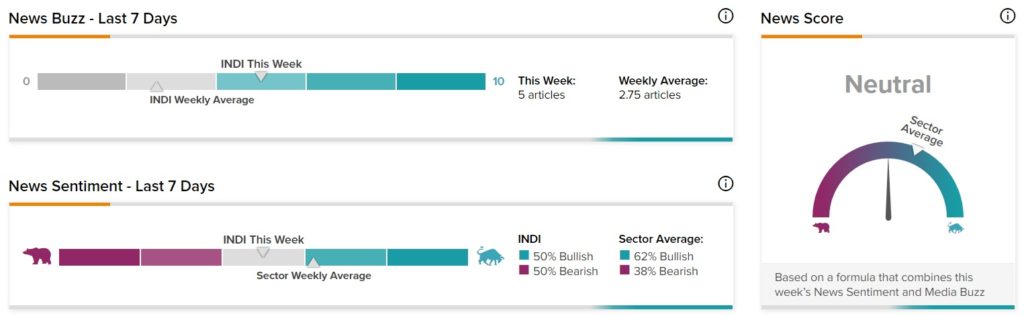

News Sentiment

News Sentiment for INDI is Neutral based on five articles over the past seven days. 50% of the articles have Bullish sentiment, compared to a sector average of 62%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Dutch Regulator Fines Apple $5.7M – Report

Kroger and Kitchen United Open Second Kitchen Center in Texas

AT&T Joins Ericsson’s Startup 5G Program