3M (NYSE:MMM), an American multinational conglomerate, recently faced a huge setback in the ongoing lawsuits over the company’s Combat Arms Earplug Version 2 products. According to the latest ruling by a United States Bankruptcy Court judge, Jeffrey Graham, in the Southern District of Indiana, Aearo Technologies’ request for imposing a preliminary injunction on the huge pile of combat earplugs lawsuits against its parent company, 3M, has been denied.

The lawsuit accuses 3M of selling faulty earplugs that damaged the hearing ability of U.S. military veterans.

The judge made the decision due to a lack of evidence that could substantiate the proposition that Aearo’s bankruptcy reorganization plan will be compromised if the lawsuits against 3M were conducted. The ruling will result in 3M having to deal with more than 230,000 lawsuits over selling faulty military earplugs.

Commenting on the court’s decision, the company said, “We are disappointed in the court’s ruling today and will be filing an appeal. Further litigation in the MDL court benefits no one.”

It is worth noting here that 3M subsidiary Aearo Technologies LLC filed for bankruptcy protection in Indiana on July 26 over the combat earplugs lawsuits. Moving on, Aearo has put $1 billion in trust to settle the lawsuits and agreed to indemnify its parent company for all liabilities related to the earplugs.

As a result of the latest court ruling, 3M will have to continue defending itself in the federal court, which costs the company nearly $3.8 million a week.

Is 3M Stock a Buy, Sell or Hold?

3M stock seems to have lost its appeal as a potential investment. According to TipRanks, MMM stock has a Moderate Sell rating based on eight Holds and four Sells. 3M’s average price target of $138.33 signals that the stock may surge nearly 7.1% from current levels.

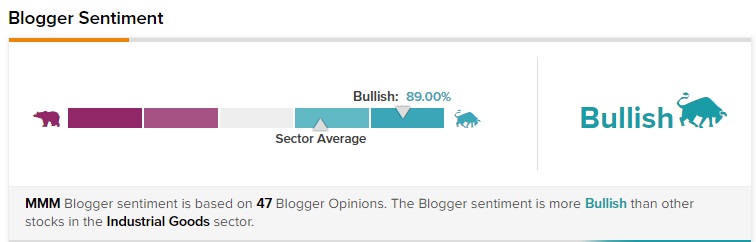

On the contrary, financial bloggers on TipRanks are 89% Bullish on 3M, compared to the sector average of 67%. Further, retail investors seem to be positive about 3M stock, as they have increased their holdings in MMM stock by 1.4% in the last 30 days.

Final Thoughts

Following the unfavorable court ruling on August 26, MMM stock saw its biggest one-day rout of 9.5% since April 2019. The avalanche of lawsuits indicates that the company is exposed to the threat of facing a huge financial liability. 3M has seen defeat in 10 of the 16 earplug cases that have gone under trial so far. It has paid nearly $265 million in total to 13 plaintiffs.

Read full Disclosure.