So we know that Target’s (TGT) third-quarter earnings report did not go well. The discount retailer probably should have done better than it did, given its push to be a value provider in a time of economic stress. But Target pinned some of the blame for its disappointing earnings on the recent U.S. port strike.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

While the strike did not last long—only about three days—Target still cited it, along with the need for ports to bring in merchandise, as a reason for its slumping sales. But media reports suggest it was less about the three days that Target could not bring in items due to the port strike, and more about what goods it brought in.

Target had imported goods valued at roughly $1.2 billion more than Walmart (WMT) did, which means Target was looking for sales on big-ticket and higher-dollar items on average. Basically, Target “…missed on its forecast for consumer demand and price-point sensitivity.”

The Weakness Likely Will Not Stop

Target just offered a forecast for the holiday shopping season, noting “flat” sales for the quarter, and also prompting the company to lower its profit forecast. Brian Cornell, Target’s CEO, noted on an analyst call that the average consumer is telling Target that “…their budgets remain stretched and they’re shopping carefully as they work to overcome the cumulative impact of multiple years of price inflation.”

This makes sense, but as we found earlier, Target is also suffering from a product mix that is short on essentials and longer on discretionary merchandise. Media reports noted that over half of Target’s merchandise is considered discretionary, putting it in a bad position in a slumping economy.

Is Target Stock a Good Buy?

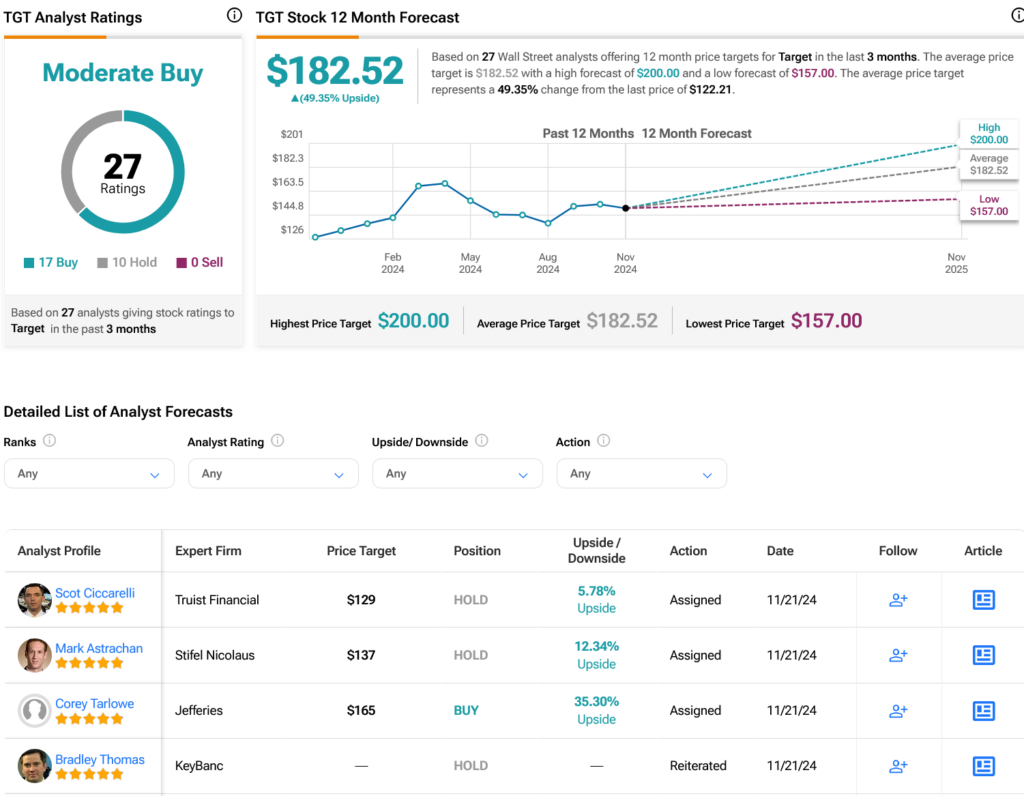

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TGT stock based on 17 Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 4.45% loss in its share price over the past year, the average TGT price target of $182.52 per share implies 49.35% upside potential.