Using TipRanks’ Best Dividend Stocks UK tool, we have identified Imperial Brands (GB:IMB), which offers an attractive dividend yield of 6.78%. This dividend tool from TipRanks compiles a detailed list of high-dividend-paying companies with several other criteria for users to compare.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let’s take a look at the details.

Imperial Brands’ Dividends History

Imperial Brands is a global tobacco manufacturer, known for its popular brands such as West, Davidoff, and Gauloises. The company follows a progressive dividend growth policy, pledging to raise its dividends annually.

Next week, the company will distribute a quarterly dividend of 22.45p for FY24. Before this, IMB paid the same amount in June 2024. This results in an interim dividend of 44.90p for 2024, representing a 4% increase over the interim payment in 2023.

In 2023, the company declared a total dividend of 146.82p per share, up from 141.17p in 2022. Overall, the company returned £2.3 billion to shareholders via dividends and share buybacks in 2023.

Moving ahead, it remains on track to complete its ongoing share buyback plan of £1.1 billion for FY24.

Is Imperial Brands a Good Stock to Buy?

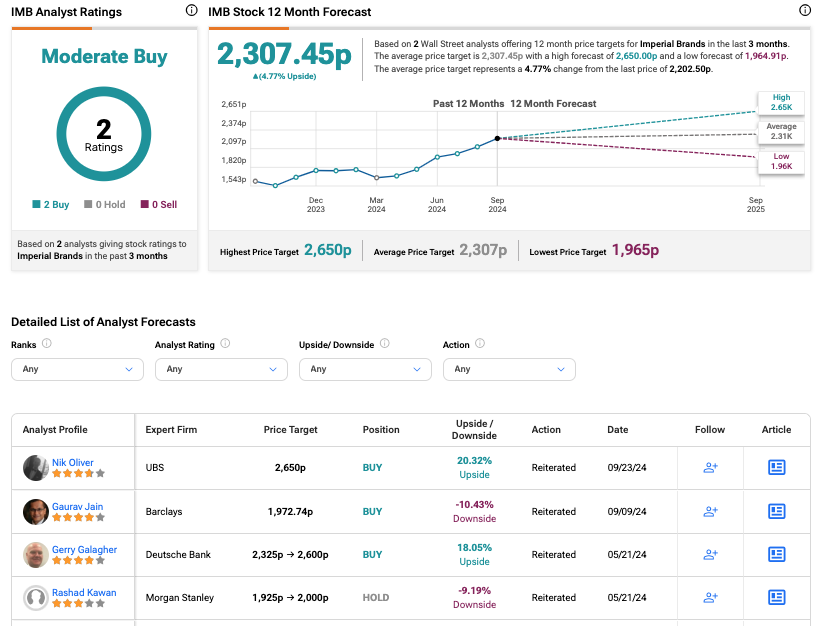

According to TipRanks’ consensus, IMB stock has received a Moderate Buy rating based on two Buy recommendations. The Imperial Brands share price target is 2,307.45p, reflecting a 5% increase from the current trading level.