Shares of Immutep exploded 63% in Wednesday’s extended trading session after the company reported encouraging first overall survival (OS) data from its ongoing Phase IIb AIPAC study assessing its lead product candidate eftilagimod alpha in patients with metastatic breast cancer.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Improving OS is considered a key endpoint when evaluating new anticancer drugs. Specifically, Immutep’s (IMMP) eftilagimod alpha was tested in combination with paclitaxel chemotherapy in comparison to a combination of placebo and paclitaxel chemotherapy in patients with HER2-negative/HR positive metastatic breast cancer (HR+ MBC). These data were selected to be presented at the San Antonio Breast Cancer Symposium 2020, which is being held virtually this week from Texas.

“AIPAC marks an important milestone for Immutep and builds our confidence that efti is beneficial for many cancer patients, including those with metastatic breast cancer,” Immutep CEO Marc Voigt stated. “We are very encouraged by these first OS results which, subject to ongoing data collection, warrant a registrational perspective and regulatory interactions towards what we hope will be an important new class of medicines.”

The first OS data demonstrated that patients being treated with eftilagimod had an improving OS trend with a median OS of 20.2 months compared to 17.5 months for patients in the placebo group. The OS analysis is based on a two-sided false positive probability of 0.05. Furthermore, a significant deterioration in the quality of life was observed for patients in the placebo group at week 25, which was not observed in the eftilagimod group.

“This is an encouraging observation as these types of benefits are supportive of efti being eligible for reimbursement upon marketing approval,” the company added.

Patients under the age of 65 years, which represented 66.7% of the participants receiving the eftilagimod treatment, reported a median OS of 21.9 months compared to 14.8 months in the placebe group.

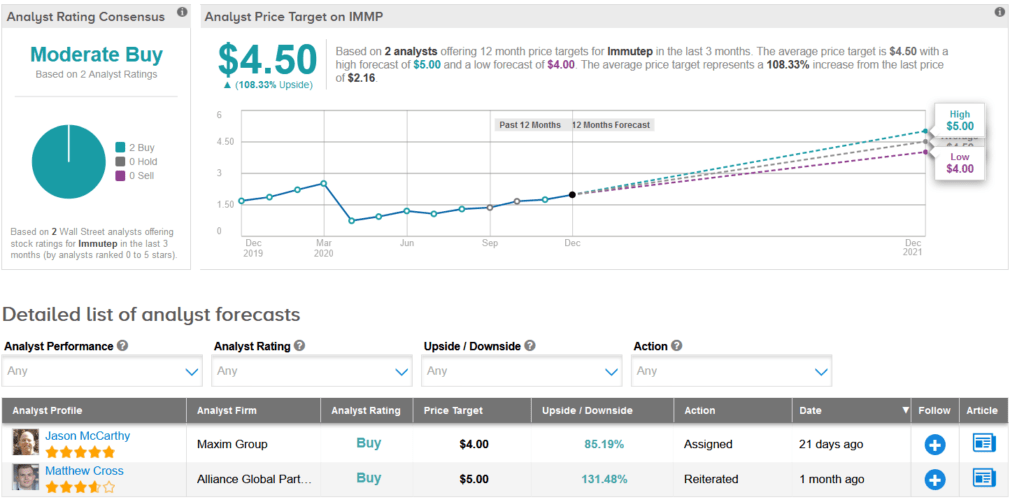

Two analysts have recently published Buy recommendations on IMMP, giving the stock a Moderate Buy analyst consensus. Meanwhile, the average analyst price target of $4.50 indicates a further 104% upside potential lies ahead. Shares are currently trading up 21% year-to-date.

Maxim Group analyst Jason McCarthy, last month reiterated a Buy rating on the stock with a price target of $4, saying that the company is continuing to build momentum behind its eftilagimod platform.

In addition, McCarthy noted that with the recently completed equity raising “combined with existing cash, the company should now have ~$38M USD in cash on the balance sheet, providing sufficient runway well into CY22.” (See IMMP stock analysis on TipRanks).

Related News:

Pfizer-BioNTech Covid-19 Vaccine Gets FDA Safety Vote; Mizuho Says Buy

Stitch Fix Surprises With 1Q Profit; Shares Spike 34%

Perion Pops 14% Pre-Market On Lifted Sales Outlook; Street Sees 35% Upside