Biotech company Immunome (NASDAQ:IMNM) has been grabbing investor’s attention this year with a bit of a Dr. Jekyll and Mr. Hyde routine. On the positive side, shares got off to a hot start, climbing over 95% into early May. In addition, the company recently announced the successful acquisition of several promising clinical-stage candidates. On the negative side, the stock has fallen over 45% since mid-May, and the company posted disappointing Q1 results.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The company is building a robust pipeline, suggesting long-term upside possibilities. Yet, treatment candidates still have a long way to go before any are market-ready, and clinical-stage failure rates are high. In the interim, investors in the stock will have to endure its high volatility, as it is a speculative opportunity suited to investors with iron stomachs.

Immunome’s Rich Pipeline

Immunome is a biotech company that uses its unique human memory B cell platform to discover and develop first-in-class antibody therapeutics. The company is focused on revolutionizing disease treatment through its innovative approach, deriving novel therapeutic antibodies and their targets from memory B cells of patients who have successfully fought off diseases. The company is steadfast in its pursuit of developing first-rate targeted cancer therapies. Its pipeline hosts a variety of modalities, including small molecules, ADCs, RLTs, and immunotherapies, each tailored to the specific biology of its target.

Immunome’s proprietary memory B cell hybridoma technology enables swift screening and functional characterization of novel antibodies and targets. Immunome aims to expand its ADC portfolio through economic business development, diligent discovery efforts, and disciplined development as part of its strategic development plan.

Recently, Immunome completed the purchase of antibodies and related assets from Atreca, Inc., and the purchase of AL101 and AL102 from Ayala Pharmaceuticals, which they believe will accelerate their efforts to bring innovative therapies to cancer patients. Furthermore, full enrollment for the Phase 3 RINGSIDE Part B study of AL102 to treat desmoid tumors was completed earlier in the year. The company projects to reveal topline data for this study in the latter half of 2025 while continuing its manufacturing and pharmacology initiatives for a new drug application for AL102.

Immunome’s Recent Financial Results

Immunome recently released its financial results for the first quarter of 2024. Reported revenue of $1.03 million fell short of the consensus estimate of $2.8 million. The company noted a net loss of -$129.5 million, equating to a basic and diluted net loss per share attributable to common stockholders of -$2.51, significantly more than the consensus expectation of -$0.69.

Much of the cost incurred during this quarter is attributable to in-process research and development expenses, which climbed notably to $112.0 million. This substantial cost results from Immunome’s acquisition of AL101 and AL102 from Ayala Pharmaceuticals and the exclusive licensing of IM-1021 and the related ADC platform technology from Zentalis Pharmaceuticals.

The company’s cash, cash equivalents, and marketable securities totaled $309.7 million as of March 31, 2024. The company’s current cash runway is expected to extend into 2026.

Is IMNM Stock a Buy?

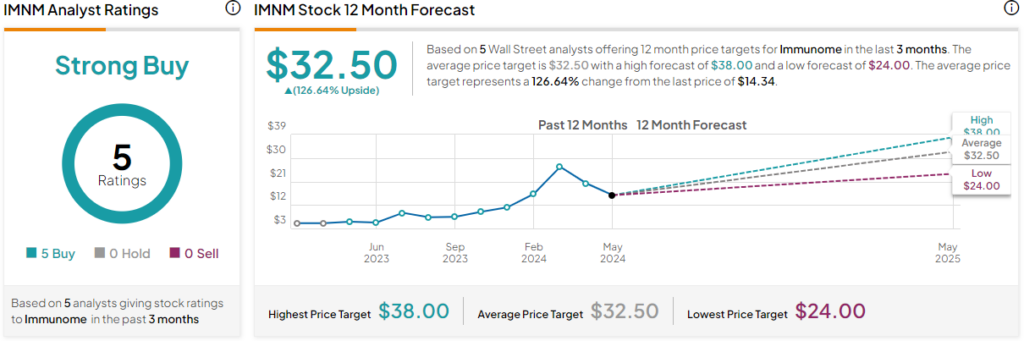

Analysts following the company have been bullish on the stock. For instance, top-rated Wedbush analyst David Nierengarten recently reiterated an Outperform rating on the shares with a price target of $33, pointing to the recent positive pipeline developments. In addition, he believes the pullback in share price is a buying opportunity for long-term investors.

Overall, Immunome is rated a Strong Buy based on recommendations and price targets collected from five Wall Street analysts over the past three months. The average price target for IMNM stock is $32.50, which represents an upside of 126.64% from current levels.

The stock has been primarily rangebound the past month and currently sits in the lower half of its 52-week price range of $4.50-$30.96. It shows negative price momentum, trading below its 20-day (15.15) and 50-day (17.03) moving averages. It appears to be slightly undervalued, with a P/B ratio of 3.0x, which is in line with the healthcare sector average but below the biotechnology industry average of 5.1x.

Bottom Line on Immunome – Commercialization Is Still Far Away

Immunome is generating some buzz with recent additions to its substantial pipeline of treatment candidates. However, commercialization is still a ways off. The stock has swung wildly up and down, with more volatility likely in store as clinical trials progress and the company pursues other potential acquisition targets. Short-term speculators may relish the choppy action, but long-term investors may want to either revisit this when a more concrete timetable for commercialization exists or be prepared to sit patiently as the circus unfolds around them.