Clinical-stage biotechnology company Immunic, Inc. (NASDAQ:IMUX) is focused on developing an orally administered, small-molecule therapy for treating multiple sclerosis (MS). In our last article, we discussed Immunic’s lead product candidate, Vidofludimus Calcium (IMU-838), and its perceived advantages as a potential treatment for MS.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The IMU-838 program is undergoing several clinical trials for the treatment of MS and its subtypes, including Relapsing MS (RMS) and Progressive MS (PMS). To date, Vidofludimus Calcium has displayed a favorable safety and tolerability profile. This is backed by the power of IMU-838’s combined effects of neuroprotective, anti-inflammatory, and anti-viral properties.

Also, the data from IMU-838’s multiple trials have shown several benefits over other treatments. Some of these advantages include targeting only hyperactive immune cells while leaving the normal immune function intact, and protecting relevant neurons from cell death. Other favorable aspects noticed include the lowering of the rate of viral infections and reactivations and an absence of hepatotoxicity signals and other relevant adverse events, leading to a low discontinuation rate for MS patients.

Currently, Immunic’s pipeline of trials includes two programs: Twin Phase 3 ENSURE Trials in RMS and Phase 2 Calliper Trial in PMS. Today, we will focus on the current and future scope of the Phase 3 Program of Vidofludimus Calcium in RMS.

Here’s More about the Twin Phase 3 ENSURE Trials in RMS

The ENSURE program involves patients who have been diagnosed with RMS and are between 18 and 55 years of age. These patients must have a history of active RMS, which includes having at least 2 relapses in the last 2 years or 1 relapse in the last year.

Immunic is currently conducting the ENSURE program at two identical multi-center, randomized, double-blind Phase 3 trials, which are focused on studying the efficacy, safety, and tolerability of Vidofludimus Calcium against placebo in RMS patients. A placebo is a treatment or drug with no therapeutic benefit.

The trials involve giving randomized double-blinded fashion of either 30 mg daily doses of Vidofludimus Calcium or of placebo. The primary endpoint for both trials is the time to first relapse up to 72 weeks. Further, the secondary endpoints of the trials include new T2-lesions, time to confirmed disability progression, time to sustained clinically relevant changes in cognition, and percentage of whole brain volume change, grey matter volume, and white matter volume.

Current Status of the Twin Phase 3 ENSURE Trials

The report from the interim futility analysis of the ENSURE program is expected in late 2024. Meanwhile, the company anticipates that the read-out of the first ENSURE trial will be in the second quarter of 2026 and the second ENSURE trial in the second half of 2026.

Future Path of the ENSURE Trials

Once Immunic completes the trials and achieves the desired endpoint results, it could apply for the U.S. FDA’s approval. When and how this happens, remains to be seen. Having said that, the commercialization of a biotech company’s first drug is usually accompanied by notable share price gains. Immunic stock could receive a boost from the commercialization of Vidofludimus Calcium.

A Sneak Peek into EMPhASIS Trial

In addition to the ENSURE trials, Immunic’s lead candidate was also the focus of the EMPhASIS trial. This trial studied the safety and efficacy of Vidofludimus Calcium in treating Relapsing-Remitting Multiple Sclerosis (RRMS).

In an April 2024 press release, the company mentioned that Vidofludimus Calcium “suppressed the development” of gadolinium-enhancing (or GD+) lesions with daily doses of 30 mg and 45 mg up to 24 weeks by 78% and 74%, respectively. The data also provided further corroboration for the selection of the 30 mg dose as the lowest effective dose.

What is the Price Prediction for Immunic?

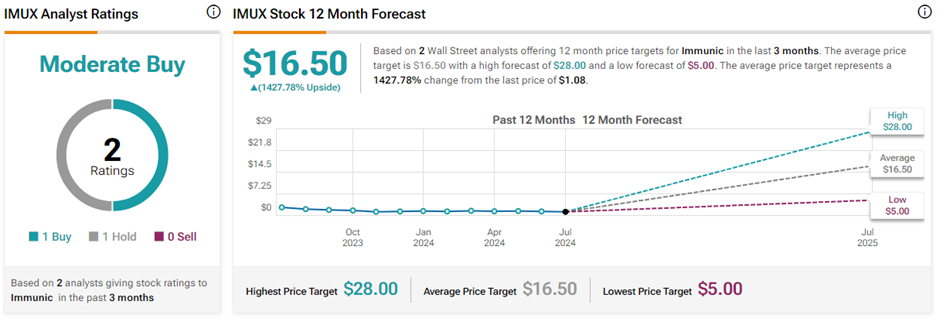

On TipRanks, the average Immunic stock price prediction of $16.50 implies a massive 1,427.8% upside potential from current levels. Also, IMUX stock has a Moderate Buy consensus rating based on one Buy and Hold rating. Year-to-date, IMUX stock has declined 25.5%.

This article was written in partnership with Immunic. TipRanks may be compensated for its publication.