Genetic sequencing company Illumina is in talks to buy Grail for a price tag of more than $8 billion, according to a Bloomberg report. A deal for the purchase of the cancer-detection startup could be announced as early as this week, according to the report. The talks may fall apart as the acquisition decision is not final yet. Illumina shares initially jumped in early trading on Wednesday but closed 8.4% lower.

Illumina (ILMN) supplies sequencers to Grail, which is used in performing genomic tests. The company is also developing a blood test to detect cancer at an early stage. Bloomberg Intelligence analyst Jonathan Palmer said that the Illumina-Grail merger would bring the testing and sequencing under one roof. The deal would also put Illumina in direct competition with its other customers, who use Illumina’s sequencers to develop their own liquid biopsies.

On Sept. 15, Illumina announced that Australian public health laboratories are aiming to sequence the virus genomes of all reported positive COVID-19 cases and track the virus using next-generation sequencing (NGS) across the country. (See ILMN stock analysis on TipRanks).

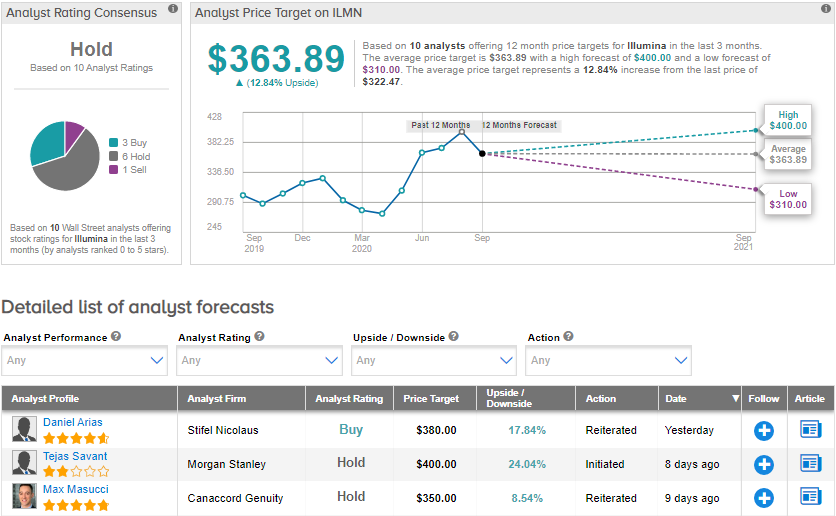

Following the announcement, Stifel Nicolaus analyst Daniel Arias reiterated a Buy rating on the stock with a price target of $380 (17.8% upside potential). Arias noted that the company is using NGS for COVID-19 tracking program in Australia, and for similar initiatives in South Africa. “While we remain cautious on the broad-based usage of NGS for infection detection, we see surveillance programs that extend across large populations as an application that will benefit greatly from NGS technologies,” the analyst added.

Currently, the Street is sidelined on the stock. The Hold analyst consensus is based on 6 Holds, 3 Buys, and 1 Sell. The average price target of $363.89 implies upside potential of about 12.8% to current levels. Shares are down 2.8% year-to-date.

Related News:

Merck Puts Focus On Lower Debt, Sees Smaller Takeovers After 2022

Abbott Starts Shipping 15-Minute Covid-19 Test After FDA Emergency Use Nod

Novavax Inks Deal With India For 2B Covid-19 Vaccine Doses In 2021

Questions or Comments about the article? Write to editor@tipranks.com