Gene sequencing firm Illumina announced today the acquisition of Grail, a company focused on multi-cancer early detection, for $8 billion. Last week, a Bloomberg report revealed that the two firms were in talks for a potential deal. Illumina stock was down 3.1% in pre-market trading today.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Illumina (ILMN) is bringing back Grail after it spun off the cancer-test start-up in 2016. Illumina is Grail’s biggest shareholder with a 14.5% stake. Grail is also backed by Amazon founder Jeff Bezos and Microsoft co-founder and philanthropist Bill Gates.

Under the terms of the agreement, Grail stockholders will also receive future payments representing a tiered single-digit percentage of certain Grail-related revenues. Illumina expects to complete the acquisition in the second half of 2021.

“Over the last four years, GRAIL’s talented team has made exceptional progress in developing the technology and clinical data required to launch the GalleriTM multi-cancer screening test. Galleri is among the most promising new tools in the fight against cancer, and we are thrilled to welcome GRAIL back to Illumina to help transform cancer care using genomics and our NGS platform,” said Francis deSouza, Illumina’s President and CEO.

“Together, we have an important opportunity to introduce routine and broadly available blood-based screening that enables early cancer detection when treatment can be more effective and less costly.”

Meanwhile, Galleri is expected to launch commercially in 2021 as a multi-cancer, laboratory-developed test for early cancer detection from blood. The Grail acquisition opens several growth opportunities for Illumina in cancer screening, diagnosis and cancer monitoring and would help in expanding in NGS (next-generation sequencing) oncology testing market, which is expected to grow to $75 billion by 2035. (See ILMN stock analysis on TipRanks)

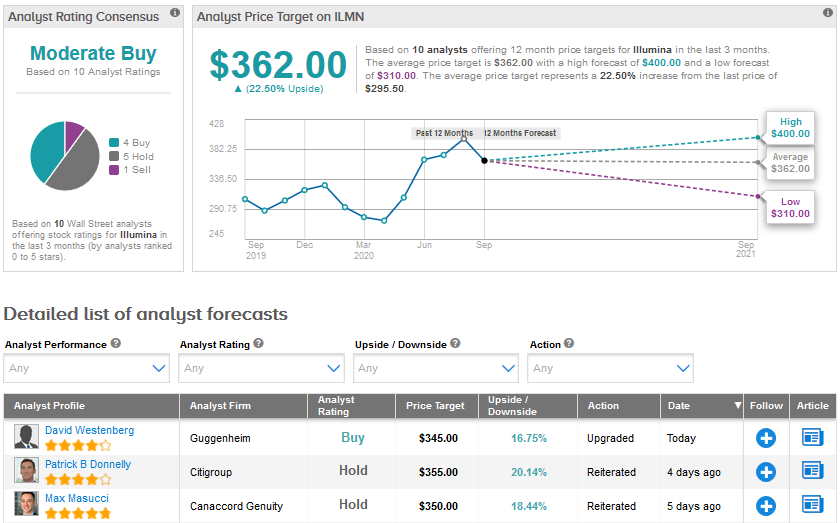

Illumina stock has fallen about 11% year-to-date. The average analyst price target of $362 suggests upside potential of 22.5% ahead.

Following today’s acquisition news, Guggenheim analyst David Westenberg upgraded Illumina to Buy from Hold with a price target of $345. The Street has a Moderate Buy consensus for Illumina based on 4 Buys, 5 Holds and 1 Sell rating.

Related News:

AstraZeneca-Merck’s Lynparza Gets Recommended By EU For Prostate, Ovarian Cancers

AlloVir Gains 14% On FDA Trial Nod For Covid-19 Therapy

AstraZeneca’s Imfinzi Trial Shows Survival In Lung Cancer Patients