U.K.-based IHS Markit Ltd. (NYSE: INFO) has reported strong financial results for the fiscal fourth quarter ended November 30, 2021.

Adjusted EPS increased 18% year-over-year to $0.85, beating the Street’s estimate of $0.83.

Revenue grew 6% year-over-year to $1.18 billion, exceeding analyst expectations of $1.14 billion.

Revenue for the Financial Services segment rose 3% to $473 million, Transportation revenue jumped 12% to $351 million, revenue for the Resources segment climbed 2% to $215 million, and Consolidated Markets & Solutions (CMS) revenue totaled $137 million, up 9% year-over-year.

IHS Markit’s Chairman and CEO, Lance Uggla, said, “We had a great close to the year and had record organic revenue growth for both the quarter and the year. We entered FY22 with strong momentum across our businesses, which sets us up well for the year.”

About IHS Markit

Based out of London, IHS Markit provides critical information, analytics, and solutions to customers in the business, finance, and government sectors. It has over 50,000 business and government customers.

Wall Street’s Take

After the release of the fourth-quarter results, Stifel Nicolaus analyst Shlomo Rosenbaum maintained a Buy rating on the stock and raised the price target from $137 to $146 (24.1% upside potential).

Additionally, Alex Kramm of UBS (NYSE: UBS) reiterated a Buy rating on IHS Markit but lowered the price target to $147 from $150 (25% upside potential).

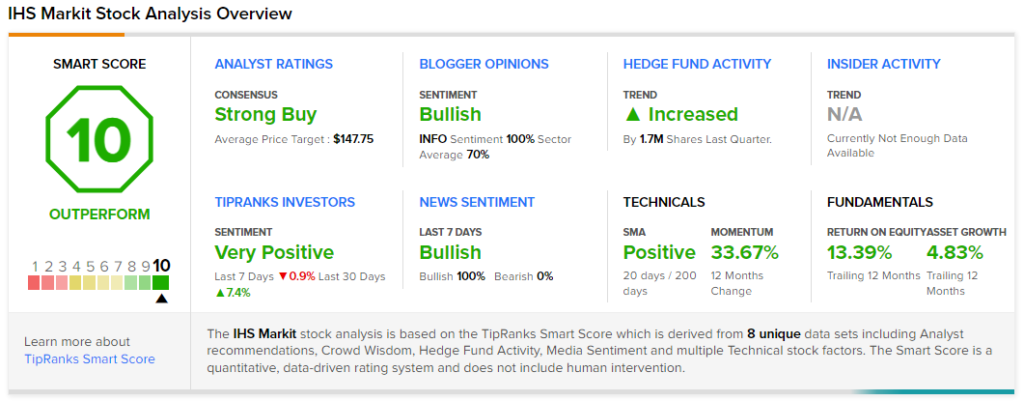

Overall, the stock has a Strong Buy consensus rating based on 4 Buys. The average INFO price target of $141.20 implies 20.02% upside potential. Shares have gained 35.3% over the past year.

Smart Score

IHS Markit scores a “Perfect 10” on TipRanks’ Smart Score rating system. This implies that the stock has strong potential to outperform market expectations, making it one of the best growth stocks for 2022.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Velocity Financial Gains on Q4 Earnings Guidance Beat

JPMorgan Streamlines EU Operations Post Brexit – Report

ViacomCBS, Nexstar Media Renew Affiliation Agreements