AMD’s (NASDAQ:AMD) recent Advancing AI event did little to lift its stock, as investors gave the chip giant’s latest updates a ‘meh’ response.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

That potential catalyst has now been and gone, but there could be another one coming up in the shape of the Q3 readout, slated toward the end of the month (unconfirmed).

In anticipation of the earnings release, TD Cowen analyst Joshua Buchalter urges investors to “ignore the noise” and recognize AMD for the opportunity it represents.

“We see a healthy setup for AMD, with Datacenter now able to drive upside after being masked by downside in other segments,” the analyst opined. “We believe the fundamental setup into 2H24 and 2025 is strong, driven by growth of the MI300/325/350 product cycles, modest upside potential in core server-CPUs, favorable PC seasonality near term, and big enough cuts to embedded/gaming.”

Buchalter expects a solid Q3 readout will be accompanied by a “modest upside” to the Q4 forecast, with new CPU and GPU products set to benefit from “strong cloud datacenter spending.”

As with previous earnings calls, Buchalter expects investor attention to focus on the MI300-series results and outlook. The analyst maintains his forecast of $4.75 billion (compared to AMD’s target of over $4.5 billion) for FY24 and is calling for $9.75 billion in FY25.

Buchalter’s channel checks “continue to reinforce” plenty of supply chain capacity and sustained demand for the company to generate “strong growth with potential for upside” in the readout.

However, external factors could still impact the timeline. Major product rollouts at large clients, including the initial MI325 shipments, are expected to cross the “artificial year-end boundary.” Consequently, any shifts in the schedule could push revenue between 2024 and 2025.

One of the key arguments of the bearish thesis on AMD is that it lacks the firepower to close the gap with Nvidia. On the other hand, the bullish case argues that if any company can chip away at Nvidia’s dominance, it’s AMD. Buchalter aligns with the latter view, noting, “We see AMD playing the long game to capture value in still ramping AI-spending vertical, setting up as the de facto alternative to and positioning its roadmap to increasingly compete with NVIDIA.”

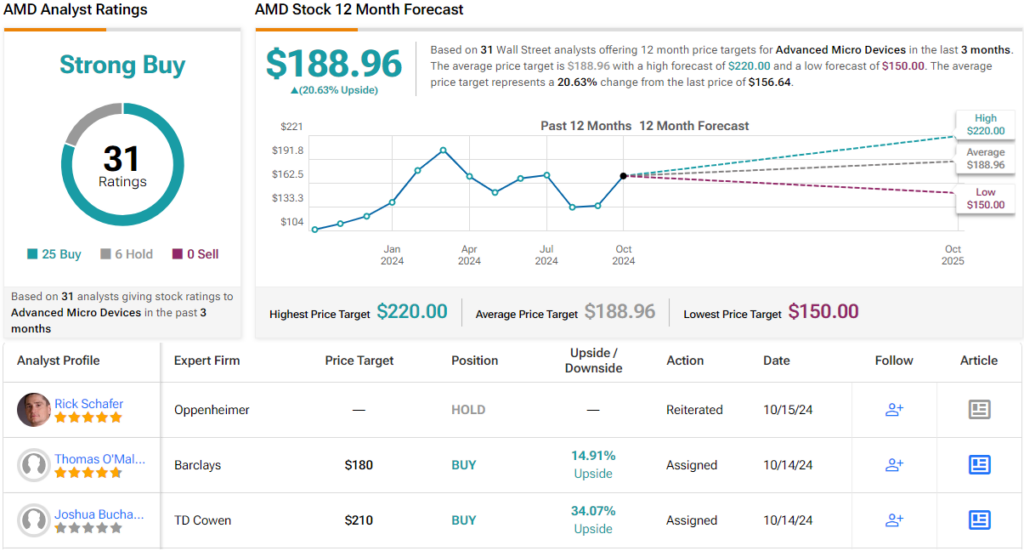

All in all, Buchalter strikes a bullish tone, rating AMD shares a Buy, along with a $210 price target, implying an upside of 34% lies in wait for the coming year. (To watch Buchalter’s track record, click here)

Buchalter is not alone in his optimism; 24 other analysts share the bullish outlook, while a minority of 6 holdouts recommend a Hold. The consensus rating is a Strong Buy, with an average price target of $188.96, implying a potential ~21% gain over the next year. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.