IDEAYA Biosciences, Inc. (IDYA) is a precision medicine oncology company, and develops targeted therapeutics for patient populations that are selected by utilizing molecular diagnostics.

Recently, IDYA acquired INQUIRE chemical library to augment its synthetic lethality drug discovery platform. INQUIRE is a small-molecule library of more than 200 thousand chemical compounds and is expected to enhance IDYA’s hit discovery capabilities across a range of novel synthetic lethality targets as well as difficult-to-drug target classes.

With this development in mind, let us take a look at the changes in IDYA’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, IDEAYA’s top risk category is Tech & Innovation, contributing 42% (compared to a sector average of 24%) to the total 74 risks identified. In its recent quarterly report, the company has changed one key risk factor under the Tech & Innovation risk category.

IDYA’s most advanced product candidate, darovasertib, is currently under evaluation in a Phase 1 trial conducted by Novartis. IDYA noted that the development of this candidate depends partly on data from this trial and that it has no control over its execution.

If Novartis sees any delay or discontinuation of this trial or any regulatory difficulty, then IDYA may have to conduct additional studies or trials independently. Such an event may mean additional costs or a delay in obtaining approval for IDYA.

Hedge Fund Activity

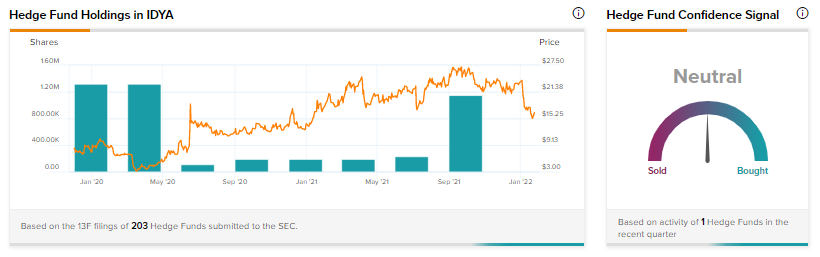

IDYA shares have slid 28.7% over the past month. Retail investors are always on the lookout for healthcare stocks to buy. According to TipRanks data, the Wall Street’s top hedge funds have increased holdings in IDEAYA by 923.3 thousand shares in the last quarter, indicating a neutral hedge fund confidence signal in the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

IBM Posts Upbeat Q4 Results; Shares Rise 2.5%

Scotiabank: COVID-19 Impacted 45% of Canadians’ Retirement Plans

Sensata Technologies Raises Share Buyback to $500M