Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), will borrow $6.5 billion in the corporate bond market to fund the $11 billion acquisition of cloud-based mortgage platform Ellie Mae.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

ICE (ICE) said the notes comprise $1.25 billion in floating rate bonds due 2023, $1 billion of 0.700% notes due 2023, $1.5 billion of 1.850% bonds due 2032, $1.25 billion of 2.650% notes due 2040 and $1.5 billion in 3.000% notes due 2060. The offering is being made under a shelf registration statement and is expected to close on Aug. 20, subject to customary closing conditions.

ICE will use the net proceeds from the debt sale, together with the issuance of commercial paper and/or borrowings under its revolving credit facility and borrowings under a new senior unsecured term loan facility, to finance the cash portion of the purchase for Ellie Mae.

Earlier this month, ICE announced that it will acquire Ellie Mae from private equity firm Thoma Bravo, and fund the deal through a combination of cash, representing 84% of the transaction value, and newly issued shares of ICE common stock, which will cover 16%. The global exchanges operator expects the acquisition to be accretive to adjusted EPS in the first full year of ownership.

ICE shares have gained almost 5% over the past 5 days taking their year-to-date advance to 12.4%. (See ICE stock analysis on TipRanks)

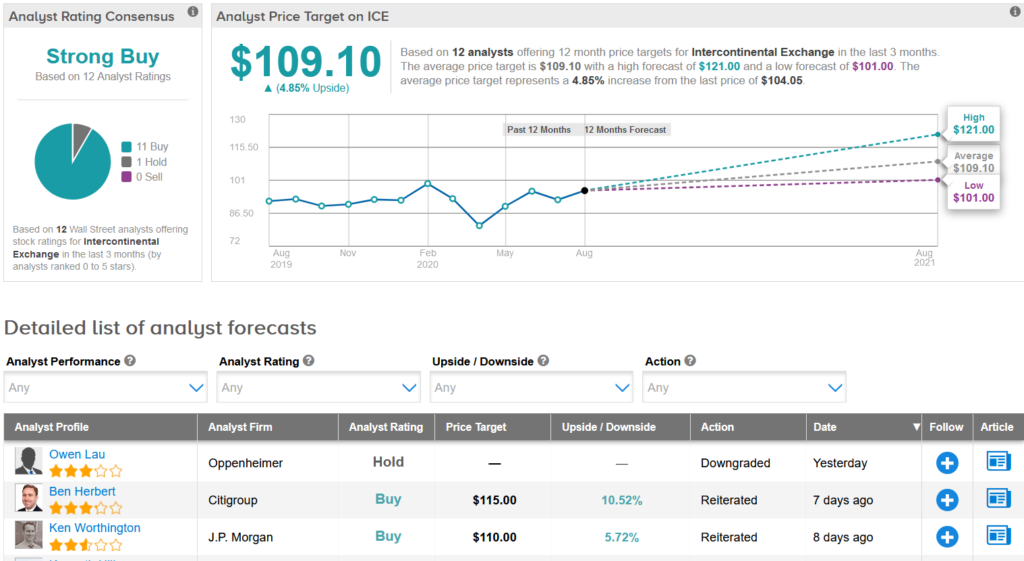

Meanwhile, Oppenheimer analyst Owen Lau on Monday downgraded ICE shares to Hold from Buy citing expectations of multiple headwinds ahead of the company over the next 1 to 2 years.

“Our analysis indicates that the “core” growth profile of ICE is lower than the market has been expecting […] organic growth has been tempering and consistently below or at the low end of a declining guidance,” Lau wrote in a note to investors. “There are meaningful integration and execution risks in Ellie Mae predicated on our ROIC analysis, and the value of the growth has substantially been captured by Thoma Bravo.”

The analyst expects the Ellie Mae acquisition to increase ICE’s EPS by 7.9% and 9.0% in 2021 and 2022, respectively, with half of the accretion coming from tax benefit of amortized acquired intangibles.

Nonetheless, the rest of the Street has a bullish outlook on the stock. The Strong Buy analyst consensus boasts 11 Buy ratings versus Lau’s Hold. The $109.10 average price target implies 4.9% upside potential over the coming year.

Related News:

ICE Buys Ellie Mae In $11B Cloud Mortgage Deal; Analysts Stay Bullish

Baidu Takes Buyback Program To $3B; Stock Down 6% Post-Print

Microsoft Confirms TikTok Purchase Talks Back On Table After Trump Call