Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange (NYSE), has entered into an agreement to buy Ellie Mae, a cloud-based platform provider for the mortgage finance industry, in a deal valued at $11 billion.

ICE (ICE) will acquire Ellie Mae from private equity firm Thoma Bravo, and fund the deal through a combination of cash, representing 84% of the transaction value, and newly issued shares of ICE common stock, which will cover 16%. The global exchanges operator expects the acquisition to be accretive to adjusted EPS in the first full year of ownership.

The deal, which strengthens ICE’s focus on providing digital services and end-to-end electronic workflow solutions to the US residential mortgage industry comes after the company bought a majority stake in MERS in 2016, purchased the remainder in 2018, and acquired Simplifile in 2019.

“Twenty years after we founded Intercontinental Exchange to provide a transparent trading platform for the energy industry, we are pleased to announce the acquisition of Ellie Mae, which will help us similarly transform the mortgage marketplace,” said ICE CEO Jeffrey C. Sprecher. “Our planned acquisition represents a one-of-a-kind opportunity to add an extraordinary enterprise with great leadership to our family. It will also enhance ICE’s growth strategy in mortgage technology.”

California-based Ellie Mae with about 1,700 employees, was founded in 1997 with the vision to automate and digitize the trillion-dollar residential mortgage industry. Through its digital lending platform, Ellie Mae provides technology services to all participants in the mortgage supply chain, including its over 3,000 customers and thousands of partners and investors.

The transaction is expected to close in the third quarter or early fourth quarter of 2020, following regulatory approvals. Following the closure, Ellie Mae will be merged into ICE Mortgage Services, creating a digital workflow solution for the US residential mortgage industry, from lead generation to origination and post-closing.

ICE shares appreciated 3.6% to $100.96 at the close on Friday taking their year-to-date advance to 9%. (See ICE stock analysis on TipRanks)

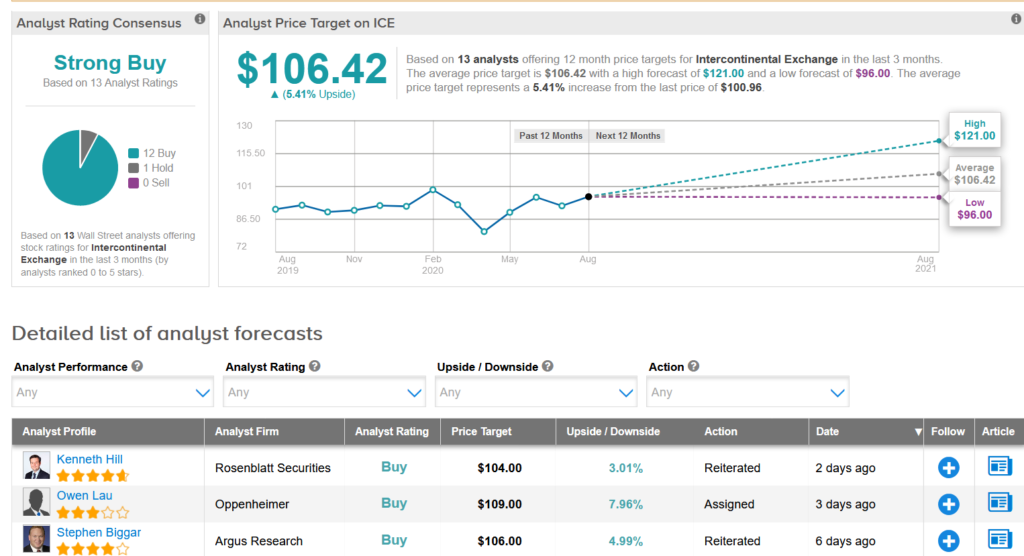

Following the announcement, Rosenblatt Securities analyst Kenneth Hill reiterated a Buy rating on the stock with a $104 price target, recommending investors should buy ICE on any softness in the shares.

“We have seen ICE take big swings since its inception to evolve trading, clearing, data services… and now mortgages. Historically, those efforts have rewarded shareholders handsomely, and we believe this will be no different,” Hill wrote in a note to investors. “We see a truly unique asset with revenue growth that will approach double digits regardless of the macro environment, provide the mortgage services business with more recurring revenue, and give ICE a very deep moat in a key area for years to come.”

Oppenheimer’s Owen Lau noted that “in light of the 8–10% organic growth, and an expandable total addressable market (TAM) currently estimated at $10B, we believe Ellie Mae will enhance the growth profile of ICE.” Lau has a Buy on the stock with a $109.

“While the growth has been tremendous, the sustainability of the growth in a post-COVID-19 world and increasing mortgage rate environment would be the key questions from investors,” he added.

Overall rest of the Street has a bullish outlook on the stock. The Strong Buy analyst consensus boasts 12 Buys versus 1 Hold. The $106.42 average price target implies 5.4% upside potential over the coming year.

Related News:

Twitter Held Early Talks To Buy TikTok’s US Operations – Report

Teladoc To Snap Up Livongo In $18.5B Virtual Care Merger Deal

Yelp Up 5% On Q2 Beat; RBC Says Stock ‘Needs A Vaccine Too’