Shares in IBM are soaring 12% in Thursday’s pre-market trading after the company announced the spin-off of its infrastructure services unit into a separate public entity to focus on its hybrid cloud platform.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

IBM (IBM) said it would separate its Managed Infrastructure Services unit from its Global Technology Services division into a new public company to create 2 industry-leading companies. The spin-off is expected to be completed by the end of 2021. Following the separation, the companies together are initially expected to pay a combined quarterly dividend that is no less than IBM’s re-spin dividend per share. Upon completion of the separation, each company’s dividend policy will be determined by its respective Board of Directors.

“IBM is laser-focused on the $1 trillion hybrid-cloud opportunities. Client buying needs for application and infrastructure services are diverging, while adoption of our hybrid cloud platform is accelerating,” said IBM CEO Arvind Krishna. “Now is the right time to create two market-leading companies focused on what they do best. IBM will focus on its open hybrid cloud platform and AI capabilities. Both companies will be on an improved growth trajectory with greater ability to partner and capture new opportunities – creating value for clients and shareholders.”

IBM added that with tighter integration and focus on its open hybrid cloud and AI solutions, it will shift from a company with more than half of its revenues in services to one with a majority in cloud software and solutions. As a result, the US chipmaker will also have more than 50% of its portfolio in recurring revenues.

The new company, which still needs to be named, will be focused on managing and modernizing client-owned infrastructures, a $500 billion market opportunity. It will offer hosting and network services, services management, infrastructure modernization, while also migrating and managing multi-cloud environments.

In addition, IBM provided preliminary financial results for the third quarter ended September 30. The chipmaker expects to report 3Q revenue of $17.6 billion and adjusted earnings per share of $2.58.

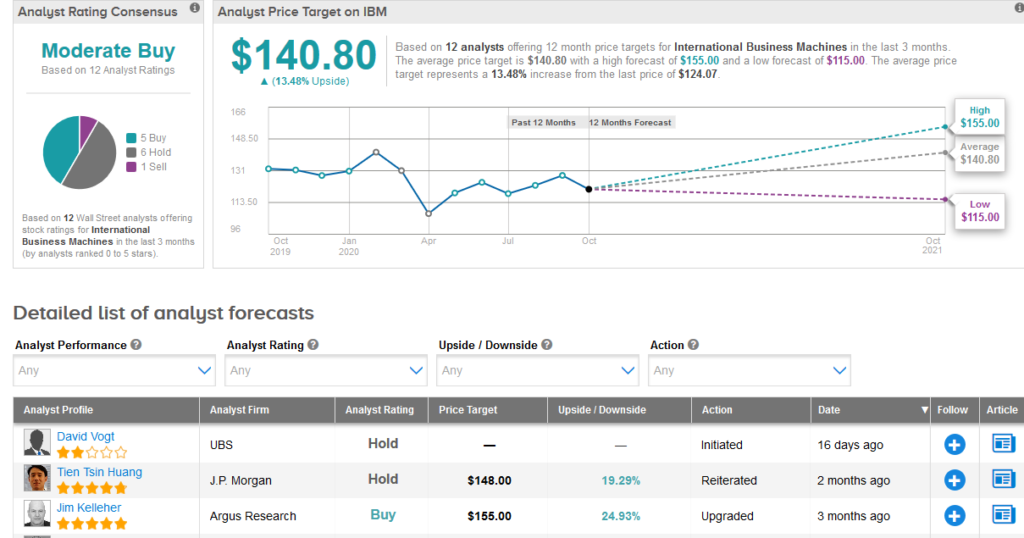

Shares in IBM, which have recouped most of this year’s earlier losses, are still down 7.5% year-to-date. Meanwhile, the $140.80 average analyst price target indicates 13.5% upside potential over the coming 12 months.

UBS analyst David Vogt last month reiterated a Hold rating on the stock, citing IBM among his least-preferred names due to “revenue headwinds arising from secular pressures”.

The rest of the Street has a cautiously optimistic outlook on the stock with a Moderate Buy analyst consensus. (See IBM stock analysis on TipRanks).

Related News:

ABB Wins Robot Orders For Covid-19 Testing In Singapore; Street Sticks To Hold

Alphatec Pops 21% On 3Q Sales Guidance Beat; Street Says Buy

Activist Loeb Urges Disney To Use Dividend Funds For Streaming Content