IBM is looking to sell its IBM Watson Health business, the Wall Street Journal has learnt. The technology giant is looking at different alternatives that include a sale to a private equity firm, another industry player, or a merger “with a blank-check company,” according to the report.

IBM’s (IBM) Watson Health business employs artificial intelligence (AI) and data analytics to enable healthcare professionals and researchers to manage their data. According to the Wall Street Journal report, this business unit earns $1 billion in revenues annually and isn’t currently profitable.

IBM is looking at increasingly focusing on hybrid cloud technology, which uses a combination of data centers and leased resources to process and manage data. In October last year, IBM had announced a decision to split the company and that it intended to separate the Managed Infrastructure Services unit into a new public company by the end of 2021.

Meanwhile, IBM saw revenues of $20.4 billion in the fourth quarter, falling short of the $20.7 billion consensus estimate. Its cloud and cognitive software unit, its biggest unit with an approximately 33.5% revenue share in 4Q20, also saw revenues drop. This unit posted revenues of $6.8 billion, reflecting a decline of 4.5% year-on-year. (See IBM stock analysis on TipRanks)

On Jan. 21, after the earnings release, Wedbush analyst Moshe Katri commented, “Maintain Neutral rating, $140 PT on IBM post another mixed quarterly performance, with Q4/CY20 revenue miss, CEPS upside as results continue to reflect an ongoing cannibalization phase of its legacy software/services revenue base (roughly 70% of mix), and potential share losses (per our recent IT advisor call, pointing to multiple $B contracts at play/risk) offset by a relatively underperforming (but growing) digital/cloud business.”

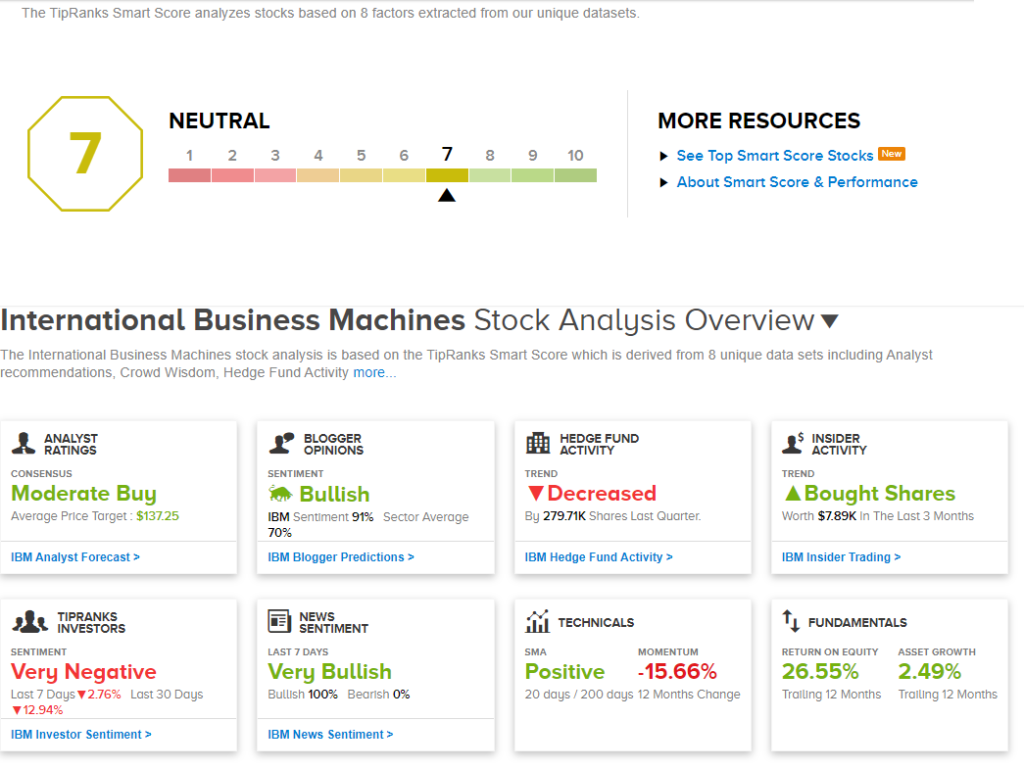

Overall, analysts are cautiously optimistic about the stock and the consensus rating is a Moderate Buy, with 1 analyst suggesting a Buy and 2 analysts recommending a Hold. The average analyst price target of $137.33 implies 4.3% upside potential to current levels.

IBM scores a 7 out of 10 on the TipRanks Smart Score system, indicating that the stock is likely to perform in line with market averages.

Related News:

Roku Posts Surprise Profit In 4Q; Surpasses 50M Active Accounts

Sleep Number Spikes 13% After Blowout Quarter; Street Says Hold

Garmin’s FY21 Outlook Beats Estimates As 4Q Results Shine