Shares of tech company International Business Machines (IBM) gained in after-hours trading after it reported earnings for its second quarter of Fiscal Year 2024. Earnings per share came in at $1.99, which missed analysts’ consensus estimate of $2.18 per share. Sales increased by 1.9% year-over-year, with revenue hitting $15.8 billion. This beat analysts’ expectations of $15.623 billion.

During the second quarter, IBM returned over $1.537 billion to shareholders, with dividends making up the entire amount. IBM is considered a very reliable dividend stock with earnings that can cover the payments. Interestingly, though, the current dividend yield seems to be near the bottom of its historical range since 2017, which suggests that the stock is relatively overvalued at the moment.

Looking forward, management now expects revenue growth for Fiscal Year 2024 to be in the mid-single-digit range, along with more than $12 billion in free cash flow.

Is IBM a Buy, Sell, or Hold?

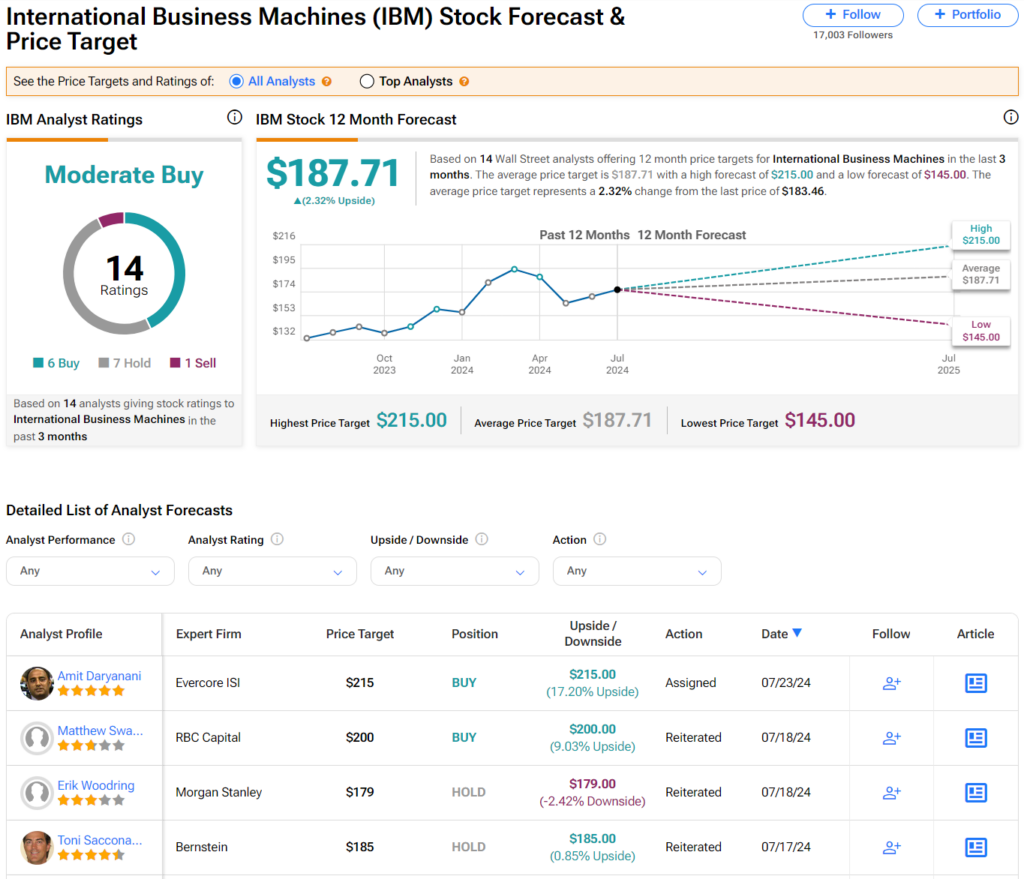

Turning to Wall Street, analysts have a Moderate Buy consensus rating on IBM stock based on six Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 36% rally in its share price over the past year, the average IBM price target of $187.71 per share implies 2.32% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.