When hurricanes strike, or any other natural disaster that fundamentally wrecks the power grid, backup generators become popular items. And for generator maker Generac (GNRC), a catastrophe for some is an opportunity. In fact, Generac stock hit a 52-week high on October 7, up nearly 8.5% in the session.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The approaching Hurricane Milton got Generac’s shares surging. With Milton poised to bring a storm surge of eight to 12 feet, it is drawing particular interest in having a backup generator in place to provide power when the grid is not up to the job.

This newfound interest in Generac products is leading an upward surge in the company’s share price, which reached a 52-week high of $169.69. But it was more than just recent interest that has been helping Generac’s share price turn around.

Building on an Earlier Program

GNRC stock has also been helped by strong financial results. The company recently reported its second-quarter earnings for 2024, with $998 million in net sales. Though Generac lost ground significantly in the commercial and industrial sector, down about 10%, an 8% growth in the residential market served to take a lot of the sting out of that loss.

Better yet, Generac improved its gross profit margin to 37.6%, keeping its expenses in check to make the most out of the cash it brought in. That combination of factors delivered a significant win for Generac’s overall operations.

Is Generac Stock a Good Buy?

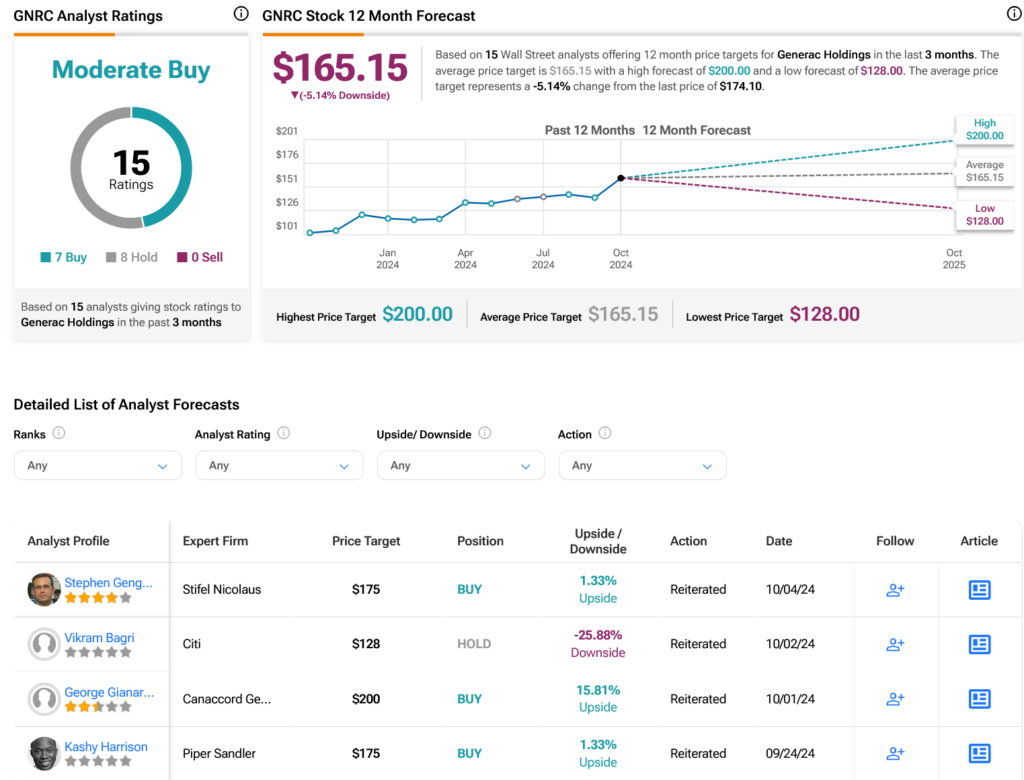

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GNRC stock based on 20 Buys and five Holds assigned in the past three months, as indicated by the graphic below. After a 9.09% rally in its share price over the past year, the average GNRC price target of $165.15 per share implies 5.14% downside risk.