Shares of HubSpot spiked 16% in Thursday’s extended trading session after the customer management software company’s quarterly profit blew past the Street consensus.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

HubSpot (HUBS) posted earnings per share (EPS) of $0.44 during the fourth quarter, which came in almost double the $0.23 expected by analysts. Revenue increased 35% year-on-year to $252.1 million, topping analysts’ estimates of $236.7 million. HubSpot has a customer relationship management platform and provides software and support to customers across 120 countries.

During fiscal 2020, HubSpot’s revenue increased to $883.03 million from $674.86 million year-on-year. Earnings rose to $1.32 per share from $1.26 during the same comparative period.

In 2020, the platform’s subscription sales jumped 32% to $853 million and professional services and other revenue was up 5% to $30 million as compared to the previous year.

HubSpot’s customer base surged 42% to 103,994 in 2020. Meanwhile, total average subscription revenue per customer declined by 3% to $9,758 in 2020 as compared to the year-ago period.

HubSpot CEO Brian Halligan said that the company achieved two major milestones in 4Q: surpassing 100,000 total customers and crossing annual recurring revenue of $1 billion.

Looking ahead to fiscal 2021, HubSpot expects total revenue to land between $1.16 billion to $1.17 billion. Earnings are estimated to generate between $1.51 to $1.59 per share. (See HubSpot stock analysis on TipRanks)

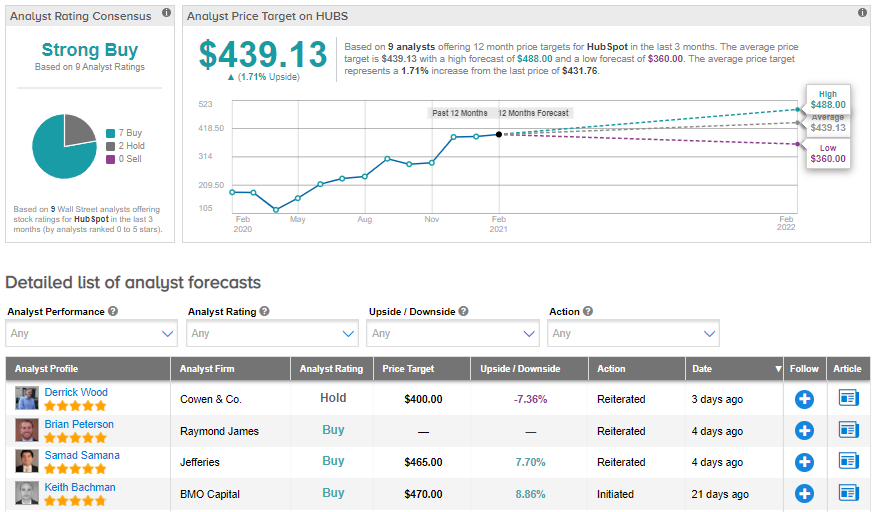

On Feb. 9, Cowen & Co. Analyst Derrick Wood raised the stock’s price target from $360 to $400 (7.4% downside potential) but reiterated a Hold rating. Derrick noted that while digital marketing trends are encouraging and HubSpot’s evolving growth strategies are promising, the valuations are rather full. The stock has already yielded 131% over the past year.

The rest of the Street has a Strong Buy consensus rating on the stock. That’s based on 7 Buys versus 2 Holds. The average analyst price target of $439.13 implies 1.71% upside from current levels.

Related News:

Baidu In Talks To Raise Funds For Semiconductor Company – Report

Peloton’s 2Q Results Top Estimates But Delivery Delays Push Shares Down

Linde’s 1Q Profit Outlook Tops Estimates After 4Q Beat; Shares Gain