HSBC Holdings PLC (GB:HSBA) (HSBC), Europe’s largest bank by market cap, is undergoing a major organizational overhaul under its new CEO Georges Elhedery. This restructuring aims to streamline operations, reduce costs, and enhance the bank’s position in key markets.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company is implementing changes to streamline its operations by reducing duplicate roles and scaling back in Western markets to concentrate on Asia and other regions with higher growth potential. Additionally, Elhedery’s restructuring plan is designed to tackle the challenges posed to the bank’s earnings growth as interest rates begin to decline.

HSBC Restructures Operations for Greater Efficiency

Importantly, HSBC is restructuring its operations into four main business lines: U.K., Hong Kong, Corporate and Institutional Banking, and International Wealth and Premier Banking. This new framework is designed to streamline processes and eliminate redundant decision-making.

Additionally, HSBC is streamlining its geographic framework by unifying Asia Pacific and the Middle East into a single division known as Eastern Markets, while Western Markets will encompass Continental Europe, the Americas, and the U.K. The CEO mentioned that this new arrangement will improve the bank’s ability to serve customers and prioritize strategic initiatives.

Kaur to Become HSBC’s First Female CFO

In a significant leadership change, HSBC appointed Pam Kaur as its first female Chief Financial Officer (CFO), effective January 1, 2025.

Kaur, who currently holds the position of Chief Risk and Compliance Officer at HSBC, takes over from Elhedery, who was recently promoted to CEO. She joined the bank in 2013 as Group Head of Internal Audit.

Is HSBC a Good Share to Buy?

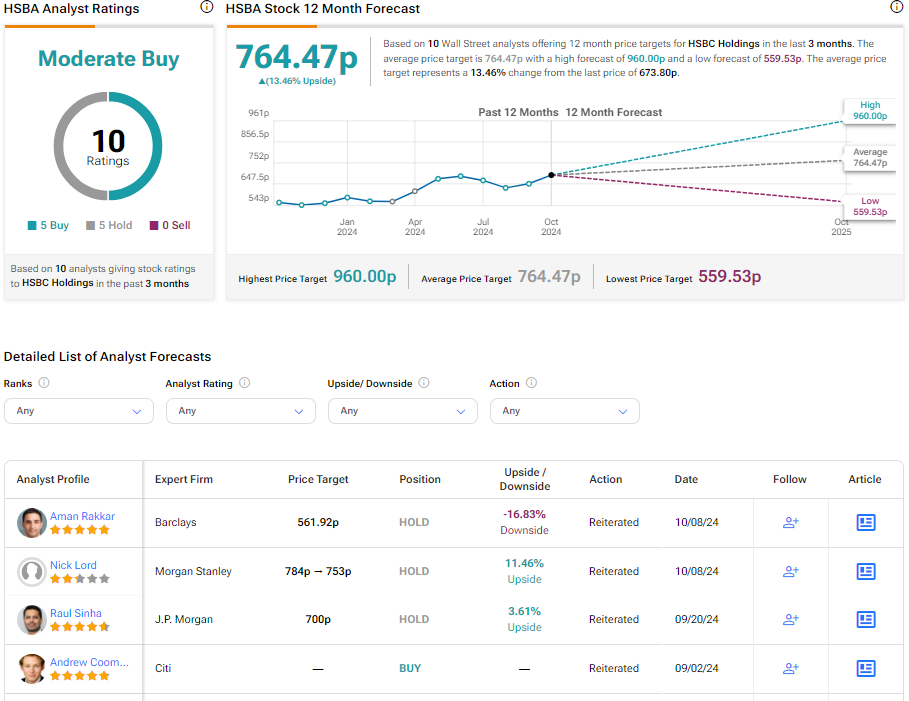

Turning to Wall Street, HSBC has a Moderate Buy consensus rating based on five Buys and five Holds assigned in the last three months. At 764.47p, the average HSBC Holdings price target implies 13.46% upside potential. Shares of the company have gained over 16% year-to-date.