HP Inc. (HPQ) has inked a deal to buy Teradici Corporation, a global innovator in remote computing software. The transaction is likely to boost the technology company’s growth in the Personal Systems category, and to provide new compute models and services customized for hybrid work.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The financial terms of the deal were kept under wraps. The transaction, which awaits regulatory approval, is anticipated to close in the fourth quarter of 2021.

Based on market statistics, HP anticipates that the adoption of hybrid work will have 67% of the workforce working remotely, at a minimum of three days a week.

Recently, HP’s ZCentral Remote Boost software has been gaining momentum, as HP is facilitating distance and hybrid work for professionals by providing remote access to physical workstations, the company said. Therefore, Teradici’s complementary set of capabilities, which are focused on cloud PCs and virtual workstations, will enhance HP’s remote compute platform.

HP’s Personal Systems CEO Alex Cho said, “Teradici’s cutting-edge technology has long been at the forefront of secure, high-performance virtual computing. Their world-class talent, industry-leading IP, and strong integrations with all major public cloud providers will expand our addressable market, and meet growing customer needs for more mobile, flexible, and secure computing solutions.” (See HP stock charts on TipRanks)

On May 28, Citigroup analyst Jim Suva maintained a Buy rating and a price target of $40 (40.9% upside potential) on the stock.

In a note to investors, Suva said that though the company reported better-than-expected Q2 results and provided upbeat guidance, full sales upside was not achieved. This might make investors consider whether this is the peak or not, he added.

Nevertheless, Suva expects that a fall in HP’s elevated shipping, logistics, and COVID costs, along with increased availability of supply-chain components, “will all help” HP in reaching its peak.

Furthermore, the analyst views investors to be “overly negative on PCs rolling over to big negative growth.” Instead, he expects the demand for a PC installed-base to increase, driven by the need for flexible work and education.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating. That’s based on 3 Buys versus 2 Holds. The average HP price target of $35.40 implies 24.7% upside potential to current levels. Shares have increased around 80% over the past year.

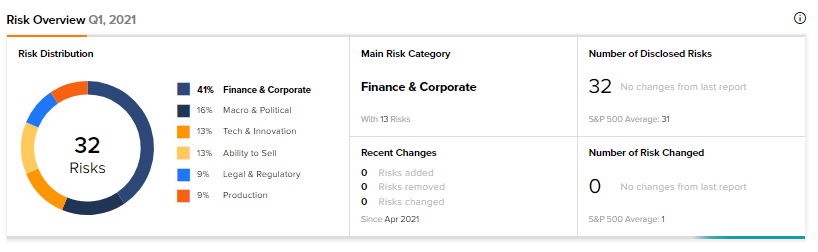

According to the new TipRanks’ Risk Factors tool, HP stock is at risk mainly from two factors: Finance and Corporate, and Macro & Political, which contribute 41% and 16%, respectively, to the total risk for the stock. Within the Finance and Corporate risk category, HPQ has 13 risks, details of which can be found on the TipRanks website.

Related News:

Fiserv Gains 2.2% on Solid Q2 Results

Becton Dickinson Acquires Tepha

ADM to Snap up Sojaprotein