Heading into HP Inc.’s (HPQ) Fiscal Q3 (FQ3) earnings on August 28, I hold a bullish stance on the Palo Alto-based company. HP has regained investor confidence by boosting growth in its Personal Systems segment, even as its Printing business struggles. Further, AI is driving the refresh cycle and increasing PC demand, offering promising long-term prospects. HP is poised to capitalize on these trends and enhance its business model, which features steady cash flows and strong shareholder returns.

If FQ2 marked the restart of Personal Systems’ growth, I expect HP to continue this momentum in FQ3.

HP’s Fiscal Q2 Signals Reacceleration in Personal Systems

When HP’s share price jumped almost 17% following its FQ2 earnings report, it was more than just a market reaction—it was a sign of a promising shift. The bullish thesis was further reinforced as the company gave the markets hope that a strong PC market could reduce its historical dependence on the Printing business.

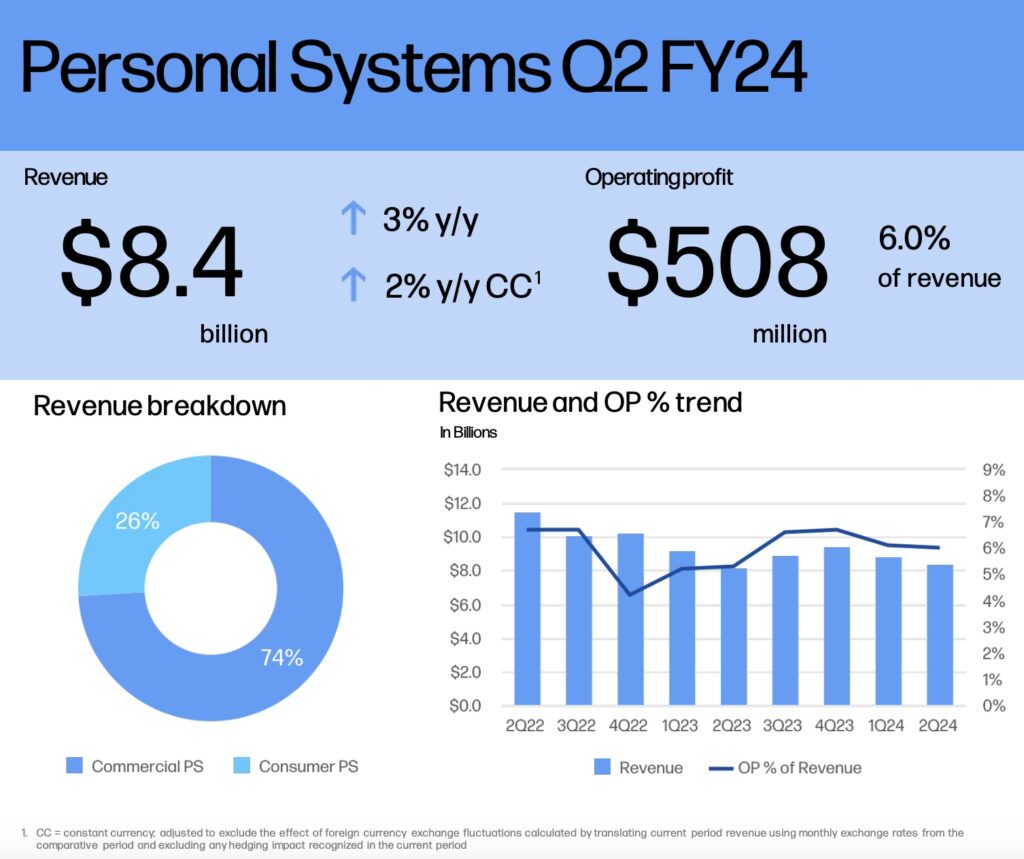

Specifically, HP operates in two main segments: (1) Printing, which remains the most profitable with $829 million in operating profit (19% of $4.4 billion revenue in FQ2), and (2) Personal Systems, the largest revenue generator at $8.4 billion, though it contributed a smaller $508 million in operating profit (6% of revenue).

Overall, HP began its fiscal year with a focus on driving profitable growth, accelerating key growth areas, and improving operational efficiencies. In the past quarter, the company successfully met these goals, delivering solid financial results with a 2% increase in operating profit and a 4% rise in EPS year-over-year. This performance was slightly above the midpoint of the previous quarter’s guidance, reflecting effective execution and strategic focus.

However, the highlight of the quarter, which prompted the big rally, was the Personal Systems segment returning to growth for the first time in eight quarters (see the image below), with a 3% revenue increase year-over-year. This turnaround suggests that HP’s strategies are beginning to yield positive results and that the market is showing signs of recovery.

Many of these strategies are closely linked to innovations in artificial intelligence. For instance, HP introduced the AI Creation Center, which offers comprehensive workstation solutions for AI development. Additionally, HP launched the industry’s largest portfolio of AI PCs, enhancing performance and privacy by running AI locally on the device.

Despite this success in reaccelerating growth in Personal Systems, it’s worth noting that the Printing segment faced challenges, with an 8% revenue decline year-over-year. This was attributed to competitive pricing and soft demand in regions such as China and Europe. Nevertheless, HP maintained disciplined cost management and an improved product mix, demonstrating resilience in the face of these pressures.

Why FQ3 Has the Potential for Another Solid Quarter

Optimism is building as the second half of Fiscal 2024 is expected to be the best yet for HP, particularly from the perspective of Personal Systems. HP already anticipates stronger demand, driven by the expected commercial PC refresh cycle and early gains from AI PCs.

Recent third-party data showed that HP’s PC shipments increased from 13.4 million in Q2 2023 to 13.7 million in Q2 2024, with the company’s market share virtually unchanged year-over-year.

However, it’s clear that this stronger demand doesn’t necessarily translate into significant short-term changes. While AI may boost PC demand in the long term, PC shipments are projected to grow at a CAGR of only around 2.4%, which doesn’t mean revenues will grow at the same rate.

Given this, HP could exceed these figures and see higher revenues if it successfully improves its average selling price (ASP), which is exactly what HP is aiming for with its AI PCs. In fact, management has guided that for Personal Systems, revenue is expected to increase sequentially by a high-single-digit percentage, with margins towards the high end of the long-term target range of 5% to 7% in Q3.

HP also reported last quarter that it expects FQ3 non-GAAP diluted EPS to be between $0.78 and $0.92, with a midpoint at $0.86, implying a flat bottom line year-over-year. Over the last three months, analysts, including nine out of 13 on Wall Street, have revised their EPS projections downward, showing some skepticism about growth, even as confidence in HP has improved following the results in Personal Systems.

Additionally, I think a more positive reaction in FQ3 could occur if HP shows signs of stabilization in its Printing revenues. If this happens in the second half of the year, it could help expand the company’s valuation multiple.

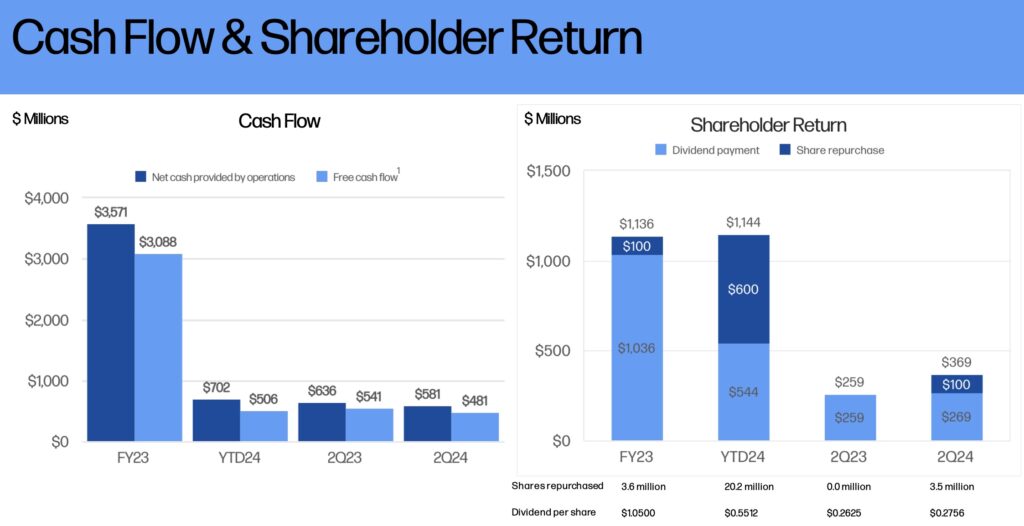

While slow top- and bottom-line growth is expected, it is somewhat offset by one of the strongest aspects of HP’s investment thesis—its ability to generate steady cash flows from its core businesses and its commitment to shareholder returns. The company’s management is committed to distributing 100% of free cash flow between share buybacks and dividends unless an exceptional opportunity arises.

Last quarter, HP reinforced its free cash flow guidance of between $3.1 and $3.6 billion for the full year. The company generated strong free cash flow, with $481 million in the quarter, more than enough to cover the $369 million spent on dividends and buybacks. I don’t see much of this trend changing in FQ3, which should likely deliver another stable and solid quarter for HP.

Is HPQ Stock a Buy, According to Analysts?

The Wall Street consensus on HPQ stock is somewhat mixed, despite a Moderate Buy rating. Out of the 11 analysts covering the stock, five are bullish, five are neutral, and only one is bearish. The average price target is $35.09, indicating 1.2% downside potential based on the latest share price.

Key Takeaways

HP is expected to deliver another solid quarter, fueled by growth in its Personal Systems segment and strong demand for AI-integrated PCs. While challenges remain in the Printing segment, HP’s steady cash flow and commitment to shareholder returns keep the bullish outlook intact. Watch for improvements in PC average selling prices and stabilization in Printing revenues as key indicators.