Airline major Delta Air Lines, Inc. (NYSE: DAL) reported mixed second-quarter results for the fiscal year ending June 30, 2022. The mixed results were on the back of revenues exceeding expectations but earnings falling short.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Following the mixed results, the stock declined 1.6% in the pre-market hours.

Revenues Rise but Earnings Decline

Delta Air Lines reported quarterly operating revenues of $13.8 billion, up 10.3% from the same period in 2019. Further, the figure topped the consensus estimate of $13.57 billion. The substantial growth of 46% from 2019 in cargo operating revenues contributed to the overall growth in revenues. However, a decline of 4% from 2019 to $10.9 billion in the company’s core passenger revenues remains a concern.

The company’s earnings per share (EPS) also plummeted 38.7% from 2019 to $1.44. Moreover, the figure failed to surpass the consensus estimate of $1.73.

Operating Metrics: What are They Indicating?

The company’s total revenue per available seat mile (TRASM) for the quarter improved by 34% from 2019 to 23.47 cents. Similarly, the quarterly cost per available seat mile (CASM) escalated by 44% for the same period to 20.89 cents.

In terms of cash flow generation, the company’s operating cash flow for the quarter came in at $2.5 billion (against $3.3 billion in 2019) while free cash flow for the quarter came in at $1.6 billion (against $2.2 billion in 2019).

Notably, the company’s operating margin declined from 17% to 11%.

Meanwhile, Delta Air Lines’ passenger load factor witnessed a slight decline from 88% in 2019 to 87%.

Third Quarter Outlook

The company also provided an outlook for the third quarter of 2022.

For the third quarter, the company expects its capacity to be down by 15%-17%. However, it expects revenue to rise by 1%-5%.

Notably, the company expects the operating margin for the quarter to hover between 11%-13%.

Management’s Commentary

CEO Delta Air Lines, Ed Bastian said, “I would like to thank our entire team for their outstanding work during a challenging operating environment for the industry as we work to restore our best-in-class reliability. Their performance coupled with strong demand drove nearly $2 billion of free cash flow as well as profitability in the first half of the year, and we are accruing profit sharing, marking a great milestone for our people.”

Wall Street’s Take

Consensus among analysts is a Strong Buy based on 11 Buys and one Hold. The DAL average price target of $50.36 implies upside potential of 62% from current levels. Shares have declined 24.8% over the past year.

Encouraging Website Traffic Data

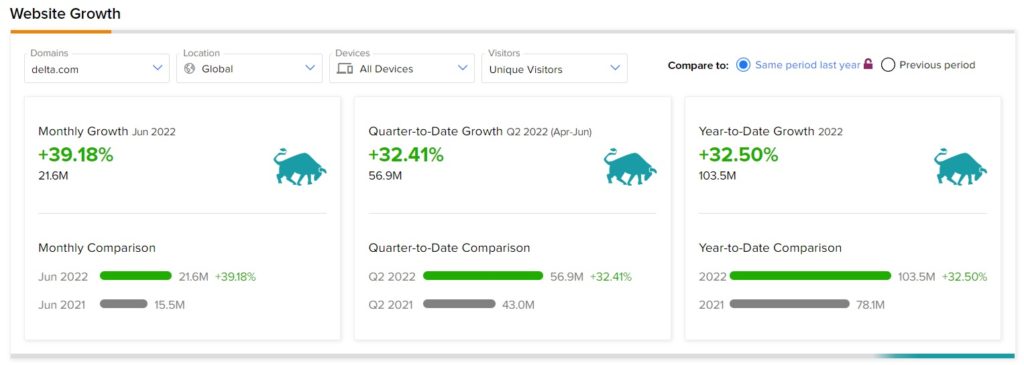

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Delta Air Lines’ performance this quarter.

According to the tool, the Delta Air Lines website recorded a 39.18% monthly rise in global visits in June, compared to May. Moreover, year-to-date, Delta Air Lines website traffic increased 32.50% compared to the previous year.

The healthy traffic witnessed on the company’s website alludes to the fact that more and more travelers are seeking to avail of the company’s services, and consequently, its operations might get a timely boost in the near future. Learn how Website Traffic can help you research your favorite stocks.

Key Takeaways

Despite various economic headwinds like rising fuel prices, high inflation, and an impending recession, Delta Air Lines’ revenues have actually witnessed an improvement from the pre-pandemic levels. This shows resilience and increasing competitive strength on the company’s part.

However, shrinking margins and a decline in earnings remain headwinds for the company. Yet, rising travel demand and the company’s sound operational strength are expected to tide it over these concerns.

Read full Disclosure