Yesterday was the big Apple (NASDAQ:AAPL) show, also known as Wonderlust. Though it rolled out a few new developments and got some people very excited for the upcoming releases, not everyone was so enthralled. In fact, Apple is down slightly in Wednesday morning’s trading as analysts digest the proceedings and discover that opinions are, at best, mixed.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Analysts definitely agree on one thing: Apple’s decision to not raise prices on devices sold in the U.S was a shock at the very least. Bernstein, for example, noted that the weaker yuan should have indicated a price hike. But the price hike never came, possibly a response to a weaker overall consumer. It might even have been Apple attempting to curry favor in advance of possible bans on iPhone use in China. That’s a point quickly refuted, though, by Credit Suisse, who noted that the reports of bans are largely overblown. Citi offered a similar sentiment only yesterday.

Yet, it’s likely a safe bet that Apple doesn’t need to worry much about iPhone sales. A WalletHub study of iPhone buyers noted that one in five respondents were willing to go into debt in order to get the latest iPhone. Almost as many—16% of respondents—believed that not having the latest iPhone is a “…sign that someone is struggling financially.” Thus, a large portion of iPhone buyers will always do so for as long as they’re able to just to keep from looking “poor.”

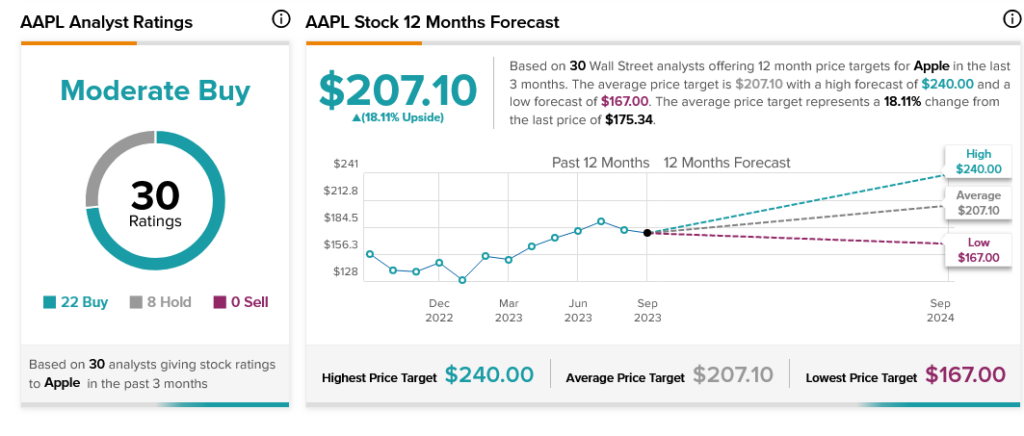

Analysts are indeed mixed, but in general, they’re on Apple’s side. A combined force of 22 Buy ratings against eight Holds make Apple stock a Moderate Buy. Further, with an average price target of $207.10, Apple stock offers investors 18.11% upside potential.