The stock of Robinhood Markets (HOOD) is down 10% after the company that runs an online trading platform reported financial results that fell short of Wall Street estimates.

Robinhood, whose mobile app allows investors to buy and sell stocks and cryptocurrencies, announced earnings per share of $0.17, which was just shy of the consensus expectation of $0.18 among analysts. Revenue in the quarter came in at $637 million, which was well below the $661 million forecast on Wall Street. Still, sales were up 36% from a year earlier.

Management blamed the disappointing results largely on matching bonuses that the company has been paying to incentivize customers to move their accounts and assets over to Robinhood from rival brokerages. Customers have received more than $200 million in matches on retirement account transfers since it began offering the incentives in January 2023, said the company.

New Products and Services

Despite missing targets on the top and bottom lines with its latest print, Robinhood still recorded strong growth in many areas of its business during the year’s third quarter. The company’s client assets increased 76% year-over-year to $152.2 billion. Transaction-based revenue grew 72% from a year ago.

The company’s gold subscription service that gives customers access to additional features on its trading app added 860,000 new additions in the quarter, bringing the total number of subscribers to 2.2 million. Robinhood has been introducing new products and services this year, including a credit card.

HOOD stock has risen 121% this year.

Is HOOD Stock a Buy?

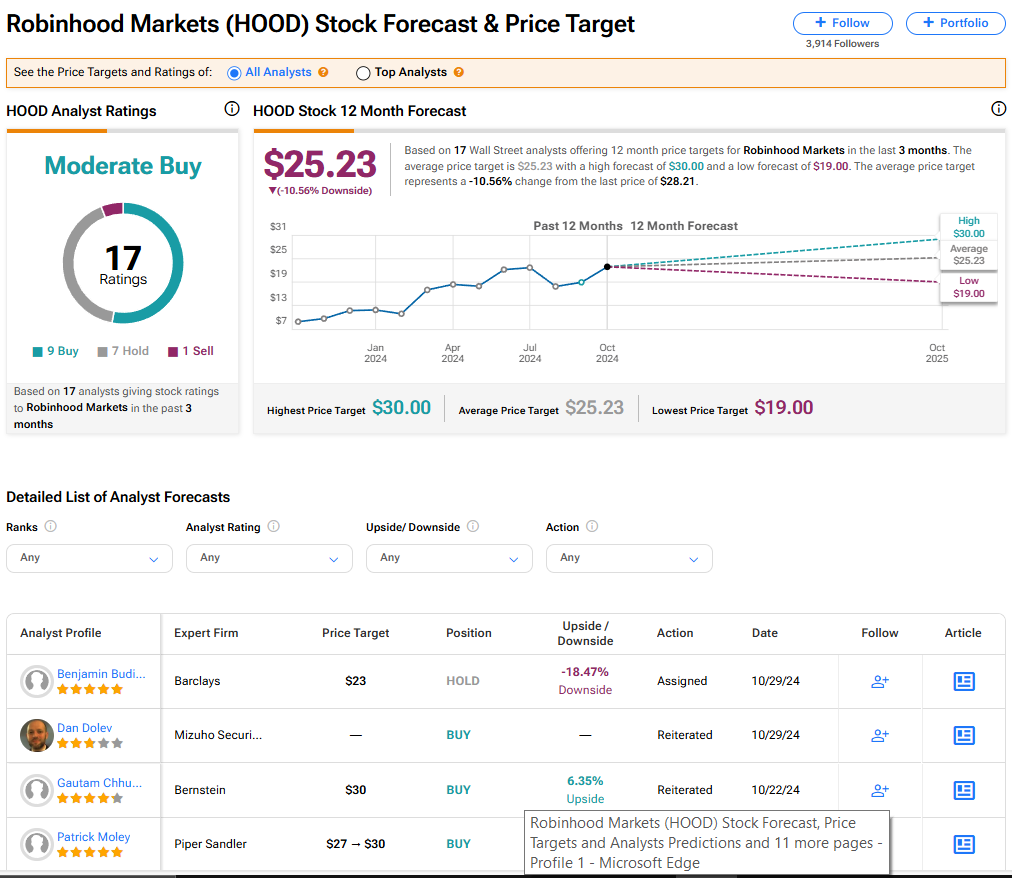

The stock of Robinhood Markets has a consensus Moderate Buy rating among 17 Wall Street analysts. That rating is based on nine Buy, seven Hold, and one Sell recommendations made in the last three months. The average HOOD price target of $25.23 implies 10.56% downside risk from current levels.