Hong Kong-listed China Evergrande Group’s (HK:3333) liquidators are demanding $6 billion from its founder, Hui Ka Yan, and other executives. According to a Hong Kong Stock Exchange filing, this legal action represents the liquidators’ first public effort to reclaim assets from Hui since the company’s liquidation in January 2024.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In related news, China Evergrande New Energy Vehicle Group (HK:0708) has announced bankruptcy and reorganization of two of its subsidiaries. These proceedings are expected to impact ongoing negotiations between the liquidators of its parent company, China Evergrande Group, and any potential buyer for the EV unit.

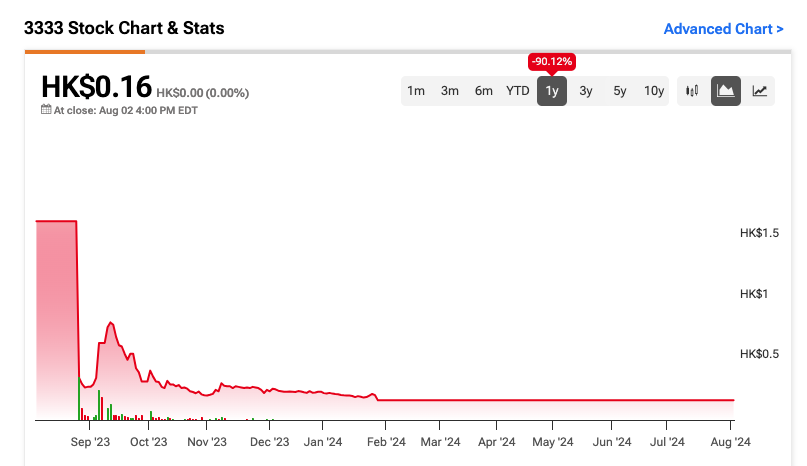

Evergrande Saga: From Boom to Bust

China Evergrande was once a prominent player in China’s real estate sector. However, the company’s huge pile of debt, an unstable macro environment, and unsuccessful negotiations with creditors led to its fall.

According to the filed documents, liquidators aim to recover around $6 billion in dividends and remuneration from founder Hui Ka Yan, CEO Xia Haijun, former CFO Pan Darong, and four other individuals and entities.

This claim is based on allegations that the company presented false financial statements between FY17 and FY20. Earlier in March, Hui Ka Yan received a lifetime ban from the securities market and was fined ¥47 million due to revenue fraud involving his flagship unit, Hengda Real Estate Group.

As part of the liquidation process, Hui’s assets in Hong Kong have already been seized or sold. However, with most of Evergrande’s assets situated in mainland China, liquidators are expected to encounter difficulties in recovering significant assets.

Following its liquidation in January, trading in Evergrande shares was suspended.