Honeywell International announced that it has acquired Australia-based technology and software as a service (SaaS) company, Sine Group, in an effort to enhance its cloud-based mobile products. However, the multinational conglomerate did not disclose the financial terms of the transaction.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

In addition, Honeywell (HON) announced that it is keeping its financial guidance for 2020 unchanged.

Sine Group provides visitor management, workplace and supply chain solutions that are accessible through mobile devices. Honeywell said, “Sine’s technologies will support a cloud-based mobile platform for Honeywell Forge, Honeywell’s enterprise performance management offering, and Sine’s software will augment Honeywell’s Connected Buildings offerings with expanded safety, security and compliance capabilities.” (See HON stock analysis on TipRanks)

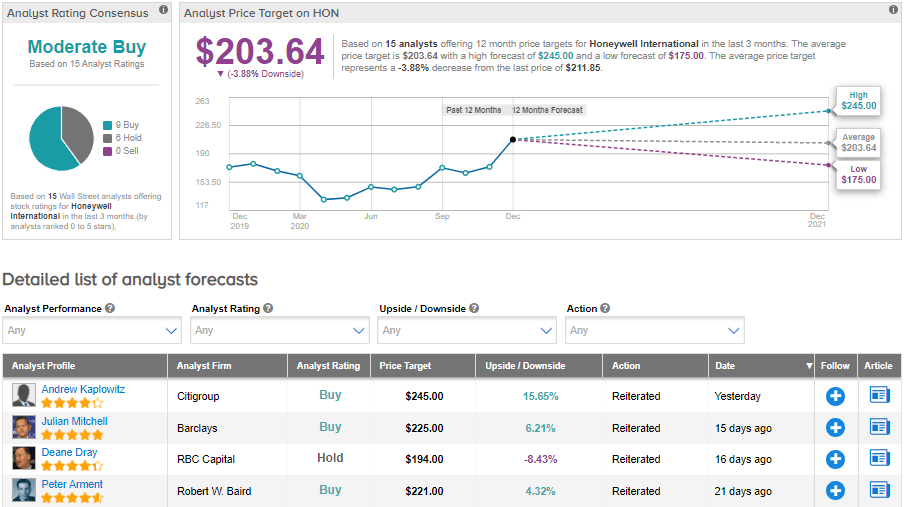

On Nov. 24, Robert W. Baird analyst Peter Arment raised the stock’s price target to $221 (4.3% upside potential) from $167 and reiterated a Buy rating. Arment also raised his earnings estimates for 2022-2023 period stating that the quick growth along with cost-saving initiatives could boost earnings over the long run.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 9 Buys and 6 Holds. The average price target stands at $203.64 and implies downside potential of about 3.9% to current levels. Shares were up by 19.7% year-to-date.

Related News:

KKR Nabs Industrial Properties Portfolio For $835M; Stock Up 36% YTD

Huntington, TCF Financial To Merge In $22B Deal; Shares Gain 5%

EA To Buy Codemasters For $1.2B; Street Is Cautiously Optimistic