Shares of multinational conglomerate Honeywell International (HON) lost nearly 1.5% on Friday despite the company reporting strong second-quarter 2021 financial results. The North Carolina-based company mainly operates in four areas — safety and productivity solutions, performance materials and technologies, building technologies and aerospace.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Adjusted earnings per share (EPS) rose 60% year-over-year to $2.04, beating the Street’s estimate of $1.93. Quarterly sales surged 18% year-over-year to $8.81 billion, marginally surpassing analysts’ expectations of $8.62 billion. (See Honeywell stock chart on TipRanks)

Aerospace sales increased 9% to $2.8 billion; sales of Honeywell Building Technologies segment grew 20% to $1.4 billion; Performance Materials and Technologies sales totaled $2.6 billion, up 15%; and sales of Safety and Productivity Solutions climbed 35% to $2.1 billion.

The Chairman and CEO of Honeywell, Darius Adamczyk, said, “As a result of the company’s second-quarter performance and management’s outlook for the remainder of the year, Honeywell raised its full-year sales, adjusted EPS, and cash flow guidance and raised the midpoint of its segment margin guidance. Full-year sales are now expected to be in the range of $34.6 billion to $35.2 billion with organic sales growth in the range of 4% to 6%. Segment margin is expected to be in the range of 20.8% – 21.1%. Adjusted EPS is expected to be $7.95 to $8.10, up 10 cents from the high end of the prior guidance range. Operating cash flow is now expected to be in the range of $5.9 billion to $6.2 billion and free cash flow is now expected to be in the range of $5.3 billion to $5.6 billion.”

On July 14, Deutsche Bank analyst Nicole DeBlase reiterated a Buy rating on the stock and lowered the price target from $246 to $245 (6.8% upside potential). Ahead of the second-quarter results, the analyst said, “Expectations for the sector are much lower than they were three months ago, as the group has underperformed the S&P 500 by seven percentage points since the end of Q1 earnings.”

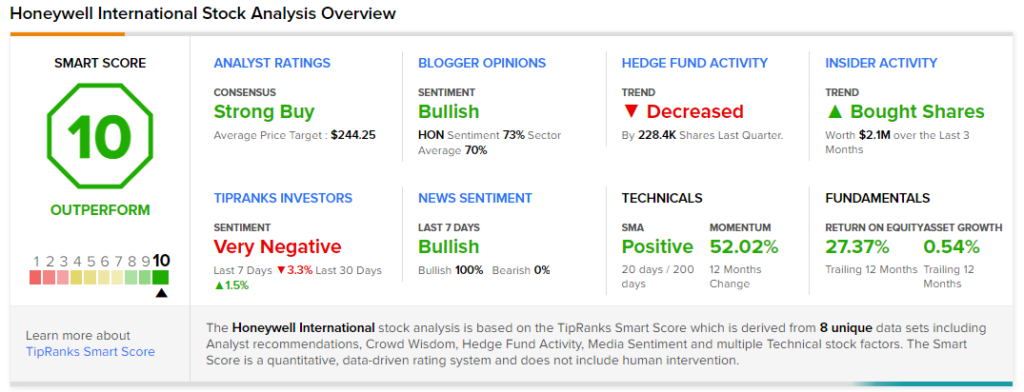

Overall, the stock has a Strong Buy consensus rating based on 4 Buys and 1 Hold. The average Honeywell International price target of $244.25 implies a 6.5% upside potential. Shares of the company have gained 52.1% over the past year.

According to TipRanks’ Smart Score rating system, Honeywell scores a “Perfect 10,” suggesting that the stock is likely to outperform market averages.

Related News:

Aecon Group: 25% Increase in Revenue; Shares Surge 9%

ImmunoPrecise’s TATX-03 Antibody Cocktail Potently Neutralizes Delta Variant

Rio Tinto Pledges $108M to Kennecott Mine Study