Hollywood film and television writers, represented by the Writers Guild of America (WGA), are going on strike starting Tuesday, after failing to reach an agreement about higher pay and other matters with studios and streaming companies like Walt Disney (NYSE:DIS) and Netflix (NASDAQ:NFLX). The strike comes as writers and the entertainment business struggle due to the drastic changes triggered by the streaming TV boom.

This marks the first strike in 15 years for the WGA, which represents about 11,500 members. The previous strike in 2007 and 2008 cost the California economy about $2.1 billion, as productions were severely disrupted. The strike is expected to first impact live television programming, including late-night shows like Jimmy Kimmel Live and The Tonight Show with Jimmy Fallon, and then streaming productions. Theatrical films would be the last to feel the impact due to the longer lead times involved.

The Alliance of Motion Picture and Television Producers (AMPTP), which represents Walt Disney, Netflix, Paramount (PARA), Apple (AAPL), Warner Bros. Discovery (WBD), NBCUniversal [owned by Comcast (CMCSA)], Sony (SONY) and others, contended that it had offered “generous” compensation hikes. However, WGA stated that the studios’ responses to its demands were not sufficient, keeping in mind the “existential crisis writers are facing.”

The AMPTP mainly has issues with certain proposals, including the need “to staff a show with a certain number of writers for a specified period of time, whether needed or not.”

Streaming giant Netflix might not face any immediate impact as indicated by the company’s co-CEO Ted Sarandos during the Q1 earnings call. Sarandos assured that if there is a strike, then the company has a large base of upcoming shows and films that could “probably” help it serve its viewers better than most of its rivals. Netflix and its peers are already under pressure to make their streaming businesses profitable after investing billions of dollars in content and operations. A strike amid macro challenges could make matters worse.

Is Netflix a Buy, Sell, or Hold?

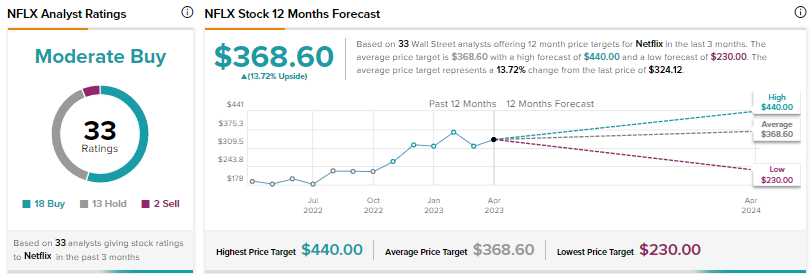

Wall Street’s Moderate Buy consensus rating on Netflix is based on 18 Buys, 13 Holds, and two Sells. The average price target of $368.60 indicates nearly 14% upside.