NuScale Power (SMR), the only SMR certified by the U.S. Nuclear Regulatory Commission, is pioneering a future in decarbonized electricity, especially for the rapidly growing data center industry. The company maintains a solid financial position with no debt and robust cash reserves while focusing on enhancing operational efficiency and reducing costs, as reflected in its recent quarterly financials. SMR is a significant player in nuclear energy and backed by over a decade of research.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

It has positioned itself to meet future data centers’ energy demand, making it a compelling option. Yet, cautious investors may want to hold off until a potential SEC inquiry is resolved.

NuScale Grapples With Short Seller

NuScale Power is a company that develops and sells modular light water reactor nuclear power plants, providing energy for a variety of applications, including electrical generation, district heating, desalination, hydrogen production, and other process heat applications. Its product line includes the NuScale Power Module (NPM), a water reactor capable of generating 77 megawatts of electricity, and VOYGR power plant designs in three different sizes, suitable for housing from one to twelve NPMs.

The firm has uniquely positioned itself to provide near-term deployment of carbon-free power to data centers. Its potential to offer consistent, uninterrupted power without external connections meets the rising demand for decarbonized electricity in the rapidly expanding data center industry.

However, the company’s shares have plummeted nearly 40% following the revelation of an investigation by the SEC’s Division of Enforcement. Short seller Hunterbrook Capital brought the inquiry to light and asserted that NuScale was under investigation, causing a significant drop in the company’s shares. The SEC has thus far upheld the confidentiality of the inquiry, merely confirming that an active investigation is ongoing but not indicating NuScale’s violation of any laws. Meanwhile, NuScale remains unaware of any investigation or potential cause for one.

Analysis of NuScale’s Recent Financial Results

The company’s recent Q2 2024 financial report revealed below-par performance. Revenue of $967,000 fell short of analysts’ expectations of $6.9 million. The company endured a net loss of $74.4 million, in stark contrast to the loss of $29.7 million in the same period the previous year. This quarter’s loss included a non-cash expense of $36.7 million due to warrant valuations. However, the reduction of $14.2 million in operational expenses showcases the company’s efforts to cut costs and enhance operational efficiency. Finally, earnings per share (EPS) of -$0.31 significantly missed the consensus estimates of -$0.14.

Compared with Q1 2024, the firm’s cash and equivalents for Q2 remained relatively stable at $136.0 million, with $5.1 million still retained as restricted funds. No debt was reported for both periods.

What Is the Price Target for SMR Stock?

Despite a recent downturn, the stock has been trending upward, climbing 144% year-to-date. It trades near the middle of its 52-week price range of $1.81 – $15.70 and shows negative price momentum, trading below its 20-day (11.59) and 50-day (9.35) moving averages.

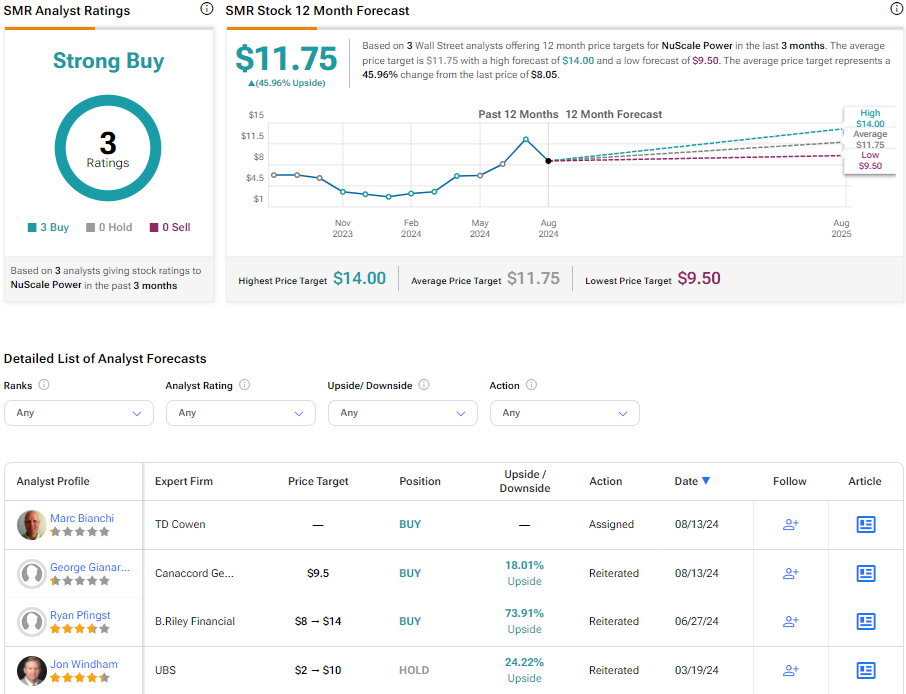

Analysts following the company have been constructive on SMR stock. For example, Canaccord analyst George Gianarikas recently raised the price target on the shares from $8 to $9.50 while maintaining a Buy rating, noting the possibility of a deal with a name-brand Western data center company.

NuScale Power is rated a Strong Buy based on the aggregate recommendations and price targets issued by three analysts. The average price target of SMR stock is $11.75, representing a potential 45.96% upside from current levels.

SMR in Summary

NuScale Power carries the baton toward a future powered by decarbonized electricity with its unique offering, the NuScale Power Module (NPM), which holds promise in meeting the increasing need for carbon-free power in blossoming industries such as data centers. However, the latest SEC investigation, currently shrouded in confidentiality, has raised eyebrows and led to a considerable decline in the company’s shares. Despite the investigation, the company retains a positive outlook, making it a potentially rewarding investment opportunity once the SEC inquiry fog is cleared.