Hilton Worldwide Holdings Inc. (NYSE: HLT) reported better-than-expected earnings for the first quarter of 2022, with the bottom line exceeding the consensus estimate by 10.9%. However, revenues in the quarter came in line with the consensus estimate.

Shares of this $41.6-billion company decreased 4.15% to close at $148.96 on Tuesday. Losses continued today, as the stock is currently down 1.6%.

Hilton is a well-known American name in the hospitality industry. It owns, franchises, and leases resorts and hotels. It is headquartered in Virginia.

Financial Highlights

Hilton Worldwide’s adjusted earnings were $0.71 per share in the first quarter, above the consensus estimate of $0.64 per share. Also, the quarter’s earnings per share improved from the year-ago adjusted tally of $0.02 per share.

Revenues were at $1.72 billion, the same as the consensus estimate of $1.72 billion. On a year-over-year basis, the top line grew 96.8%.

The company’s revenues in the Management and Franchise segment increased 77.8% year-over-year to $512 million. Sales in the Ownership segment were $150 million, surging 167.9% from the year-ago quarter.

Exiting the quarter, the company had 6,892 properties and 1.08 million rooms. Its occupancy rate in the first quarter was 58.1%, up 1,460 bps year-over-year, and its average daily rate (ADR) was at $139.17, reflecting 35.2% growth from the year-ago quarter. Revenue per available room (RevPAR) was $80.84, up 80.5% year-over-year.

Total expenses in the quarter increased 58.5% year-over-year to $1.35 billion. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) in the quarter were $448 million, up 126.3% year-over-year, while the margin expanded 1,110 bps to 66.1%.

Balance Sheet and Cash Flow

Exiting the first quarter, Hilton Worldwide had cash and cash equivalents of $1.43 billion, up 0.4% from the end of 2021. Its long-term debt was at $8.72 billion, reflecting a slight sequential growth of 0.1%.

In the quarter, the company’s net cash flow from operating activities was $195 million, compared with a net cash outflow of $171 million in the year-ago quarter. Capital expenditure in the quarter was $4 million, higher compared with $3 million in the first quarter of 2021.

Projections

For the second quarter of 2022, Hilton Worldwide predicts adjusted earnings to be within the $0.98-$1.03 per share range. Adjusted EBITDA is expected to be $590-$610 million. RevPAR in the quarter is projected to grow 45%-50% from the year-ago quarter.

For 2022, the company anticipates adjusted earnings to be $3.77-$4.02 per share. It also predicts adjusted EBITDA to vary within the $2,250-$2,350 million range.

Also, the company expects RevPAR to increase 32%-38% year-over-year while the net unit is projected to increase 5%. Rewards to shareholders in the year are likely to vary within the $1.4-$1.8 billion range.

Official Comments

Hilton Worldwide’s President and CEO, Christopher J. Nassetta, opined that impressive first-quarter results and healthy recovery expected from the remainder of the year equipped the company for rewarding shareholders with dividends and share buybacks.

He added that the company is well-positioned for the future and “excited for the growth opportunities that lie ahead.”

Capital Deployment

In the first quarter of 2022, Hilton Worldwide’s repayment of debts amounted to $13 million, while its share repurchases totaled $121 million.

Through April, the company’s share buybacks were $265 million. In May, the company got its board of directors’ approval for the payment of a quarterly dividend of $0.15 per share in the second quarter.

Wall Street’s Take

Yesterday, Steve Sakwa of Evercore ISI initiated its coverage on Hilton Worldwide with a Hold rating and a price target of $155 (6.1% upside potential).

Overall, the company has a Moderate Buy consensus rating based on three Buys and eight Holds from the analyst community. Hilton Worldwide’s average price target of $153.82 suggests 5.3% upside potential from current levels.

Over the past year, shares of Hilton Worldwide rallied 16.2%.

Risk Analysis

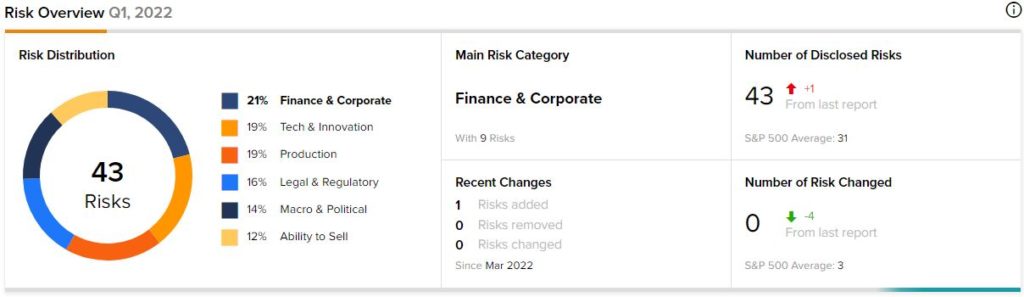

According to the TipRanks Risk Factors tool, Hilton Worldwide’s main risk category is Finance & Corporate, accounting for nine of the total 43 risks identified for the company.

Conclusion

Hilton Worldwide seems to be recovering well from the difficulties created by the pandemic. This is evident from the company’s impressive first-quarter results and improvements in key metrics mentioned above. Also, the company’s development efforts and rewards to shareholders will help boost its attractiveness.

However, the company’s huge expenses and a highly-leveraged balance sheet might not be attractive to all investors.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Lyft Drives Upbeat Q1 Results; Website Visits Hinted at it

Paramount Global Gains Subscribers, Loses Ground in Market

Onsemi Stock Rallies on Upbeat Q1 Results