Hilton Worldwide Holdings surprised investors with a quarterly profit as the hotel operator is starting to see “meaningful” improvement in occupancy demand from the pandemic-led travel slump. Shares are rising 1.6% in Wednesday’s pre-market trading.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Hilton (HLT) earned 6 cents per share in the third quarter, compared with analysts’ expectations for a loss of 2 cents per share. Total sales plunged 61% to $933 million and missed the Street consensus of $963.5 million.

System-wide comparable RevPAR or revenue per available room, a key metric of the hotel industry, dropped 59.9% to $44.95 in the third quarter on a currency neutral basis year-on-year, which is below the $47.50 forecasted by analysts. However, the metric improved from the 81% slump recorded in the previous quarter.

“Our third quarter results show meaningful improvement over the second quarter. The vast majority of our properties around the world are now open and have gradually begun to recover from the limitations that the COVID-19 pandemic has imposed on the travel industry, with occupancy increasing more than 20 percentage points from the second quarter,” Hilton CEO Christopher J. Nassetta said. “While a full recovery will take time, we are well positioned to capture rising demand and execute on growth opportunities.”

Hilton disclosed that since April, system-wide occupancy has increased month over month, with the most notable regional recoveries in Asia Pacific, the US and Europe. System-wide occupancy in the third quarter was 42.5% versus 79.1% a year ago and compared with 22.3% in the prior quarter. As of Nov. 2, 97% of Hilton’s system-wide hotels were open.

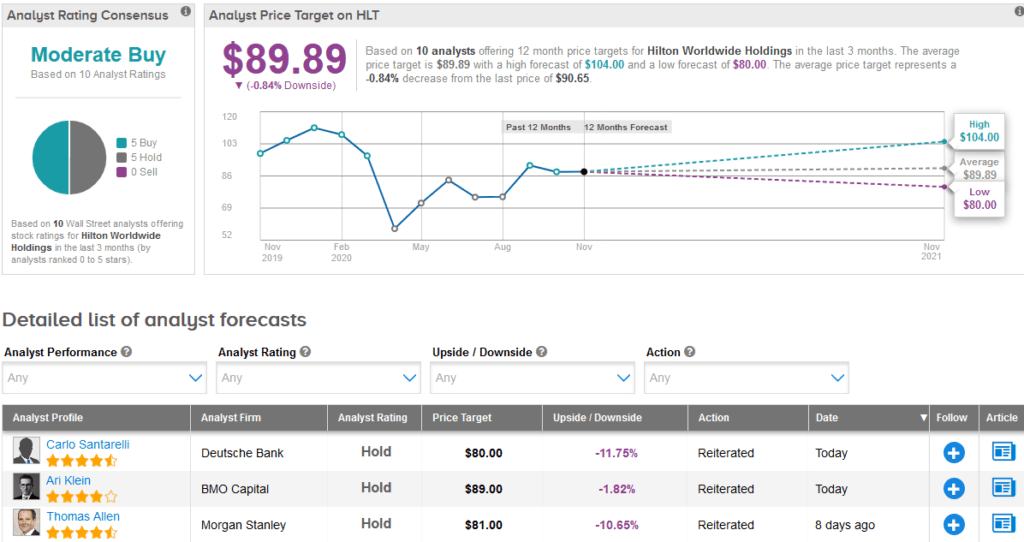

HLT shares have gained 16% over the past 3 months but are still down 18% since the start of the year. That’s with a Moderate Buy consensus assigned by Wall Street analysts based on 5 Buys and 5 Holds. Meanwhile, the average price target suggests the stock is more than fully priced and is poised for downside potential.

In reaction to the earnings results, BMO Capital analyst Ari Klein reiterated a Hold rating on the stock with a $89 price target.

“HLT reported results that were better-than-expected on the key metrics as we await an update on the global impact from recently rising COVID cases,” Klein wrote in a flash note to investors. “Over the next few years, we expect cancellations/delays in rooms not currently under construction plus fewer new adds to the development pipeline to weigh on NUG.” (See HLT stock analysis on TipRanks)

Related News:

Wendy’s Drops 4% In Pre-Market As Quarterly Sales Disappoint

Baker Hughes Snaps Up Compact Carbon Capture For Energy Transition Path

AT&T Mulls Sale Of DirecTV Stake – Report