Hillenbrand announced that it has completed the sale of its Red Valve business to DeZURIK Inc. for $63 million. The deal price includes a cash payment of $58 million and notes payable worth $5 million. The diversified industrial company bought the Red Valve business, back in Feb. 2016, for a purchase price of $131.9 million in cash.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Hillenbrand (HI) said that it plans to use the Red Valve sale proceeds for deleveraging its balance sheet, which is consistent with its current capital allocation priorities.

Hillenbrand’s CEO Joe Raver commented, “We are excited to announce the sale of the Red Valve business, which is in line with our commitment to driving shareholder value by focusing on our key business platforms.” He added that, “The timely divestiture of Red Valve results in increased financial flexibility and enhances overall shareholder value.” (See HI stock analysis on TipRanks).

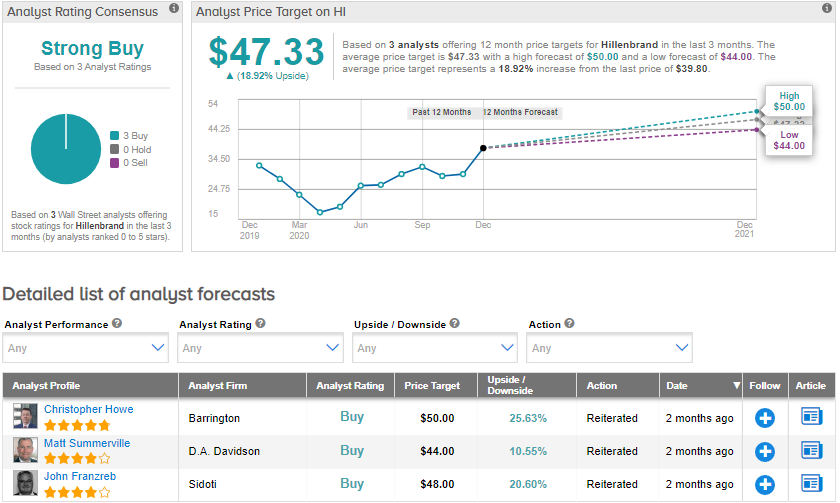

Earlier on Nov. 16, D.A. Davidson analyst Matt Summerville raised the stock’s price target to $44 (10.6% upside potential) from $42 and maintained a Buy rating. In a note to investors, Summerville said that Hillenbrand’s FY20 free cash flows have “materially” improved the company’s balance sheet leverage. Further, the analyst believes that the company has an “attractive” dividend yield.

Meanwhile, the Street has a bullish outlook with an analyst consensus of a Strong Buy based on 3 unanimous Buys. The average analyst price target stands at $47.33, which implies upside potential of about 18.9% to current levels. Shares have increased 19.5% in 2020.

Related News:

Ensign Group Snaps Up Three Nursing Facilities; Street Firmly Bullish

Roku On Cusp Of Deal To Buy Quibi’s Content Catalog – Report

MGM Looks to Acquire Entain and Move into Online Gambling – Report