The market’s response to sporting goods company Hibbett’s (NASDAQ:HIBB) recent earnings miss and soft forward guidance has been swift, with shares dropping almost 9% the following day. Despite the recent volatility, the company continues to focus on growing its footprint in underserved markets while benefiting from general industry growth tailwinds. HIBB stock is a compelling option for value investors seeking income.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sneaker Central

Hibbett Sports operates Hibbett stores, City Gear stores, Sports Additions athletic shoe stores, and various online channels, including its websites and dedicated apps. Its product range focuses on athletic footwear, team sports equipment, and athletic and fashion apparel. The company is known for having a unique retail presence in underserved markets.

Hibbett has demonstrated consistent growth over decades, significantly elevating its sales by a noteworthy five-fold increase between 2001 and 2020. This growth has been complemented by a sharp reduction of nearly 50% in share count, underscoring the firm’s commitment to boosting shareholder value through share repurchases.

The athletic shoe industry experienced a significant revenue drop due to the COVID-19 pandemic, which forced the closure of many non-essential businesses. However, as the economy rebounded, there has been a surge in consumer interest in athletic shoes. Market forecasts indicate the growth trend to continue over the next five years through 2028.

Recent Results Failed to Impress

Hibbett’s results for the fourth quarter of Fiscal 2024 (ended February 3, 2024) missed Wall Street’s expectations on both earnings per share (EPS) and revenue. The retailer reported an EPS of $2.55, just shy of the consensus $2.56, and net sales of $466.6 million, compared to the projected $477.33 million.

Compounding matters, the company’s Q4 comparable sales declined by 6.4%. Despite these figures, Hibbett’s overall financial performance for the year remained strong, with annual sales rising 1.2% to $1.73 billion.

For Fiscal 2025, Hibbett projects EPS between $8.00 and $8.75, falling slightly short of the consensus expectation of $8.82. Additionally, the company estimates a gross margin of 34.2% to 34.5%. The guidance includes net store growth of 45-50 units, signaling an expansion of operations, while capital expenditures are projected to range from $65 million-$75 million.

Where the Stock Stands Now

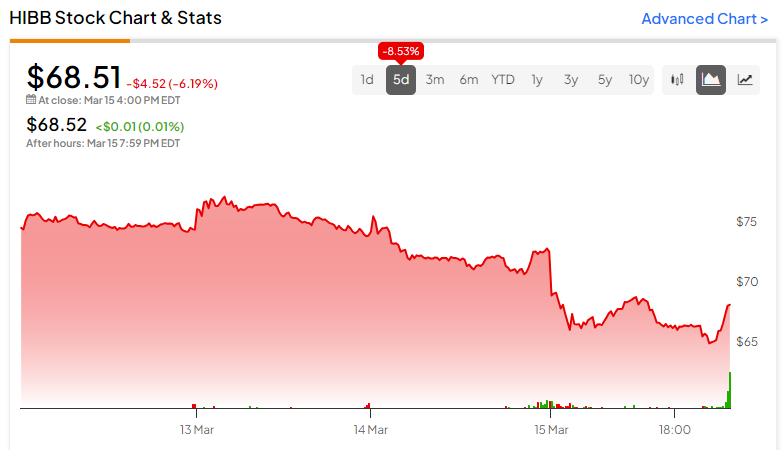

Though HIBB stock has been on an upward trend, climbing over 15% in the past year, the earnings miss and underwhelming outlook for the current fiscal year have caused the stock to come under pressure, plunging nearly 9% in the past five days. With a last closing price of $68.51, the stock is trading toward the upper middle of its 52-week range of $34.86-$83.00.

After the recent bout of volatility, the stock trades in undervalued territory across various comparable metrics. Its P/E ratio of 8x is below the Consumer Cyclical sector average of 17.9x and the Apparel Retail industry average of 27.3x. The TTM EV/EBITDA of 4.48x sits well below the industry average of 14.8x.

Furthermore, the company’s board recently declared a dividend payment of $0.25 per share, set to be distributed on April 2, 2024. This action subsequently boosts the dividend yield on the stock to 1.3%. This adds an attractive component for investors seeking income.

Is HIBB a Good Stock to Buy?

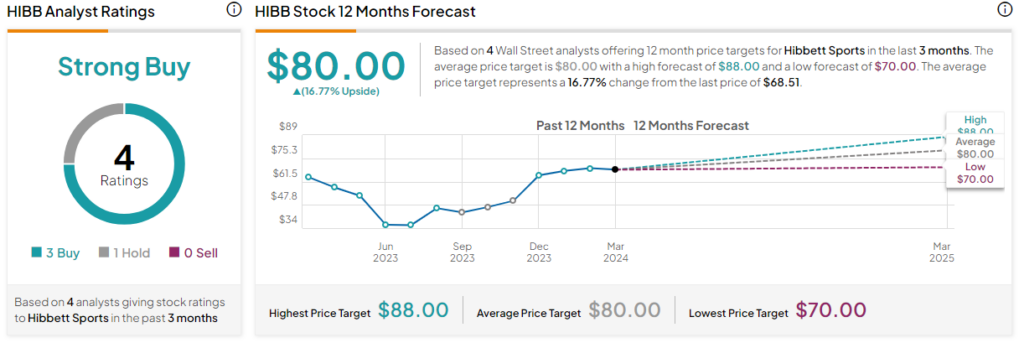

There is a mixed opinion among analysts covering HIBB stock. BofA analyst Alexander Perry recently reiterated a Sell rating on the stock with a price target of $50 based on the softening of same-store sales. Meanwhile, Telsey Advisory analyst Cristina Fernandez increased the price target for Hibbett stock from $73 to $82 and maintained a Buy rating based on growing market demand and the company’s unique retail presence in underserved, small markets.

HIBB is currently listed as a Strong Buy based on three Buys and one Hold rating in the past three months. The average HIBB stock price target of $80 represents an upside potential of 16.77% from current levels.

Big Picture for HIBB

Hibbett Sports is a smaller player in athletic footwear and sports equipment retail, carving out a unique (and highly desirable) niche. Despite a slight drop in EPS and revenue in the latest quarter, the company boasts an impressive track record of consistent growth, robust sales, and strategic share repurchases, all signaling a commitment to delivering value to its shareholders. Its undervalued stock price and appealing dividend yield offer an attractive investment opportunity for value investors seeking an income component.