Hewlett Packard Enterprise raised its FY21 outlook after reporting better-than-expected 4Q results. Shares of the information-technology giant were down 1.43% in Wednesday’s pre-market trading as 4Q earnings declined 24.5% year-over-year to $0.37 per share, but surpassed analysts’ estimates of $0.34.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Hewlett Packard’s (HPE) 4Q revenues remained flat at $7.2 billion but exceeded the Street’s estimates of $6.9 billion.

Hewlett Packard’s CEO Antonio Neri said, “The global pandemic has forced businesses to rethink everything from remote work and collaboration to business continuity and data insight.” He added, “In Q4 we saw a notable rebound in our overall revenue, with particular acceleration in key growth areas of our business.”

Revenue grew 6% sequentially in 4Q driven by strong growth in the company’s High Performance Compute & Mission Critical Systems and Intelligent Edge businesses, it said.

As for 1Q, Hewlett Packard expects adjusted earnings to be in the range of $0.40-$0.44 per share, surpassing analysts’ estimates of $0.35. Moreover, the company raised its fiscal 2021 EPS guidance to $1.60-$1.78, up from its earlier guidance range of $1.56-$1.76. Analysts’ FY21 estimates stood at $1.32 per share. (See HPE stock analysis on TipRanks)

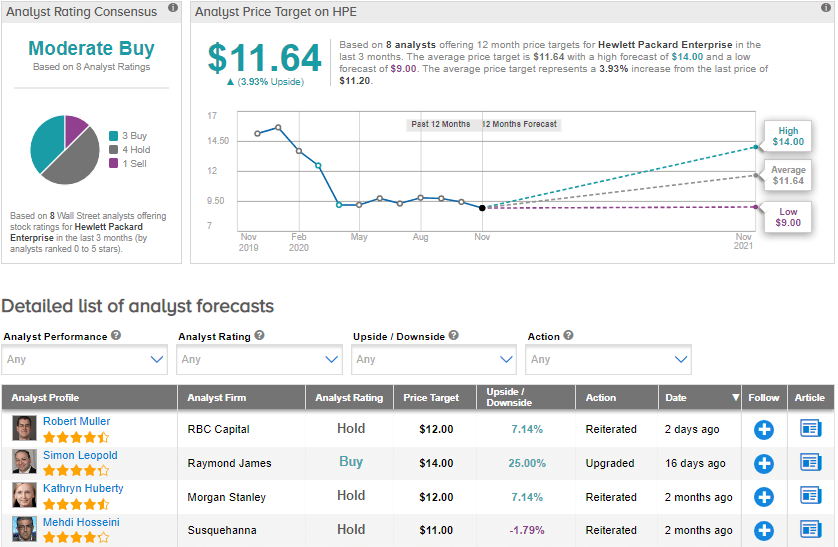

On Nov. 16, Raymond James analyst Simon Leopold upgraded the stock’s rating to Buy from Hold and maintained a price target at $14 (25% upside potential), citing “improving fundamentals and upside to estimates.” He sees “HPE’s position as better than appreciated.” Leopold added, “we envision upside potential for the Servers in a macro recovery.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 3 Buys, 4 Holds and 1 Sell. The average price target stands at $11.64 and implies upside potential of about 3.9% to current levels. Shares have declined by 29.4% year-to-date.

Related News:

Box Drops 6% After Dim 4Q Sales Outlook; Oppenheimer Sticks To Buy

Salesforce Crushes 3Q Estimates; Shares Slip 4.8%

Inter Parfums’ 2021 Guidance Lags The Street’s Call; Shares Fall