Shares of office-furniture maker Herman Miller are soaring about 15% in Thursday’s pre-market session after the company posted better-than-anticipated results for the first quarter of fiscal 2021.

In the 1Q ended August 29, Herman Miller’s (MLHR) sales declined 6.6% Y/Y to $626.8 million, exceeding analysts’ estimates of $524.8 million. The company’s top-line benefited from the elevated backlog levels at the start of the quarter, which partially reflected the impact of manufacturing and project scheduling disruptions experienced in fiscal 2020’s fourth quarter.

Adjusted EPS in 1Q rose 47.6% to $1.24 year-on-year driven by significant margin expansion owing to favorable channel and product mix and higher productivity. Analysts had expected EPS of $0.26 for the quarter.

The company’s retail business gained from robust demand in the Home Office category and from growth in other home categories like upholstery, outdoor, and accessories. E-commerce sales were a key growth driver for the retail business with overall web sales and orders growing 248% and 257% Y/Y, respectively, across the company’s Herman Miller, DWR, and HAY websites in North America.

However, the pandemic adversely impacted Herman Miller’s North America contract business. Internationally, the company experienced improved demand in Asia-Pacific and Europe.

The company re-established its dividends backed by strong results and its liquidity position. It will pay a dividend per share of $0.1875 on Jan. 15, 2021 to shareholders of record as of Nov. 28, 2020. (See MLHR stock analysis on TipRanks)

Looking ahead, the company did not offer any specific sales and earnings guidance but disclosed that consolidated orders were down 10% Y/Y in the first two weeks of the second quarter and that backlog at the end of the first quarter was flat Y/Y. Operating income is expected to deleverage in the range of 25% to 30% over time, Herman Miller added.

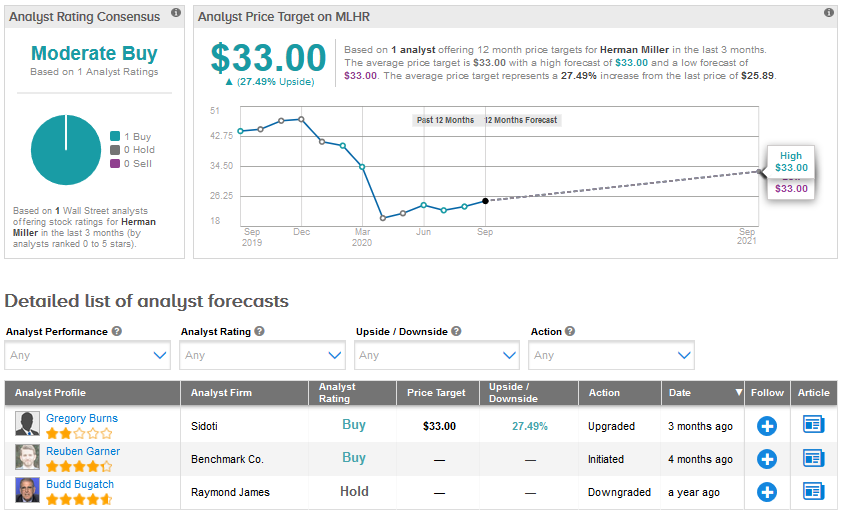

The stock has declined about 38% year-to-date, with the $33 analyst price target indicating upside potential of about 28% over the coming year.

Back in June, Sidoti analyst Gregory Burns upgraded Herman Miller to Buy from Hold and raised the price target to $33 from $26, following fiscal 2020’s 4Q results that he called “much” better than expected.

Related News:

Nikola Short Squeeze Could be Coming Very Soon, Says S3 Partners

Tapestry Spikes Over 9% As Deutsche Bank Turns Bullish

Sony’s PS5 Will Go On Sale For $499 In November