Taiwan Semiconductor Manufacturing (NYSE:TSM) stock gained about 3% at the time of writing. The upside comes after the Taiwanese contract chipmaker said it expects revenues for the global semiconductor industry to grow by 10% in 2024. The company anticipates that opportunities in the artificial intelligence (AI) space will support sales growth.

Furthermore, TSMC plans to boost its chip-on-wafer-on-substrate (CoWoS) production capacity at a CAGR (compound annual growth rate) of over 60% until at least 2026. Investors should note that CoWoS is an advanced packaging technology for high-performance computing (HPC) and AI components.

Analysts Upbeat About TSM’s Growth Prospects

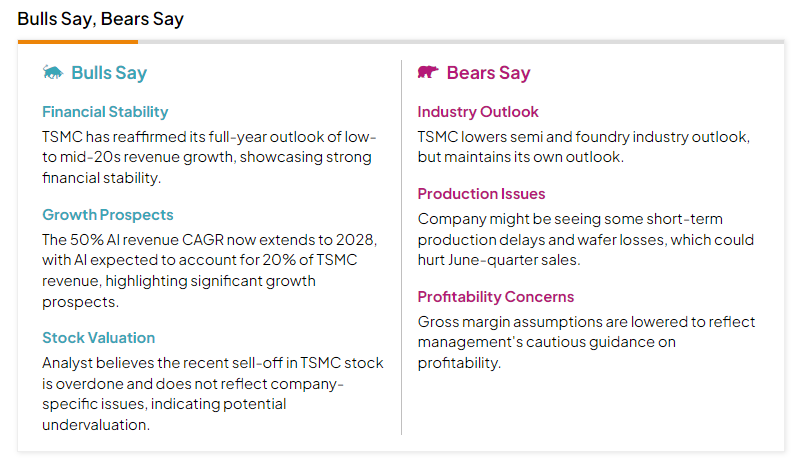

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bullish on TSM believe that expectations of 50% AI revenue CAGR until 2028 and AI accounting for 20% of TSMC’s revenue, reflect significant growth prospects for the company.

Furthermore, on May 22, Needham analyst Charles Shi reiterated his Buy rating on TSMC stock with a price target of $168, suggesting a 7.59% upside potential. Shi ranks among the top 1% of Street stock experts. (To watch Shi’s track record, click here.)

The analyst is bullish about the company’s growth prospects. He noted that TSM’s plans to expand production capacity will help the company meet the growing demand for its semiconductor products.

Will TSM Stock Go Up?

The company’s ties with high-profile clients such as Apple (AAPL) and Nvidia (NVDA), along with its efforts to meet the rising AI demand, are encouraging.

Overall, the stock has a Strong Buy consensus rating on TipRanks. This is based on 11 unanimous Buy recommendations. Analysts’ average price target on TSM stock of $163.11 implies 4.46% upside potential. Shares of the company have gained about 61% over the past six months.

Importantly, the stock has a Smart Score of “Perfect 10” on TipRanks. Stocks with the perfect Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.