Squarespace (SQSP) fell 3.1% on July 25 despite the company delivering a blowout second-quarter earnings beat. Investors were disappointed by the FY2022 revenue guidance, which fell below analysts’ expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Based in New York, Squarespace Inc. is an all-in-one website-building platform for businesses and independent creators. The company offers pre-built website templates that can be used to create and modify webpages to help clients build an online presence, grow their brands and manage their businesses across the internet.

SQSP Q2 Numbers

Positively, earnings of $0.45 per share impressively beat analysts’ expectations of $0.09 per share and were higher than the reported loss of $3.22 per share for the prior-year period.

Although revenues gained 9% year-over-year to $212.7 million, they were in line with consensus estimates of $212.01 million.

Commerce revenue grew 13% to $66.2 million, unique subscriptions grew 6% to 4.2 million, and average revenue per unique subscription (ARPUS) increased 6% to $204.

SQSP Revenue Outlook Below Expectations

Based on the current scenario, management provided financial guidance for the third quarter and full-year FY2022, which fell below analysts’ expectations.

The company forecast FY2022 revenues to grow by 9% to 11% (in the range of $857 million to $867 million), lower than the consensus estimate of $873.61 billion.

For the third quarter, revenues are projected to grow 6% to 8% (in the range of $213 million to $218 million), versus the consensus estimate of $221.58 million.

SQSP CEO’s Comments

Squarespace CEO, Anthony Casalena, commented, “Our recent launch of Fluid Engine, a core enhancement to our page building experience, represents a major step forward in no-code web design for professionals and beginners and we are excited it is now available to customers globally.”

Wall Street’s Take on SQSP

Following the Q2 results, JMP Securities analyst Andrew Boone reiterated a Hold rating on the stock.

Disappointed by the muted revenue guidance, Boone cautioned that they may have to cut their mid-teens growth estimates for 2023 due to signs of a slowdown in revenue growth implied in the outlook provided by the management.

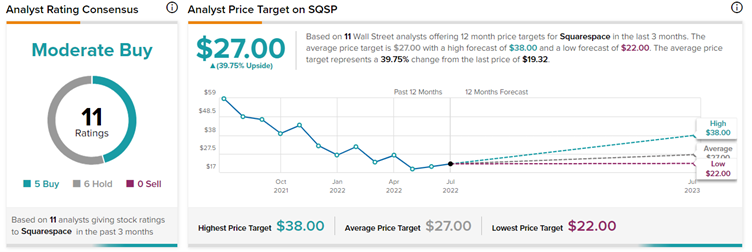

However, the rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on five Buys and six Holds. The average Squarespace price target of $27 implies a 39.75% upside potential to current levels.

Bloggers Weigh In on SQSP

TipRanks data shows that financial blogger opinions are 100% Bullish on SQSP stock, compared to a sector average of 65%.

Concluding Thoughts

Shares of Squarespace have lost over 65% of their market capitalization over the past year, hugely underperforming the benchmark indices.

Currency headwinds were clearly a drag on the quarterly results as pointed out by the top management. Investors will perhaps wait for better visibility on revenue growth before taking a position in the stock.