Pliant Therapeutics (NASDAQ:PLRX), the clinical-stage biotechnology company, announced an underwritten public offering of $175 million of its common stock. Following the news, PLRX stock rose over 3% in Monday’s extended trading, reflecting investors’ optimism about the company’s growth plans.

The after-market rally was also a continuation of the solid upside momentum witnessed in yesterday’s trading session. The stock closed about 35% higher on Monday after Pliant released positive interim data from a phase 2a trial of its drug bexotegrast. The drug will be used to treat idiopathic pulmonary fibrosis, a type of lung disease.

It is worth mentioning that the company plans to use the net proceeds and existing other liquid assets held on its balance sheet to fund the ongoing and future trials, including bexotegrast and PLN-101095.

Is PLRX a Buy?

Following the trial results, one of Needham’s top analysts, Joseph Stringer, maintained a Buy rating on PLRX stock and raised the price target to $45 from $40.

The stock is appealing to the analyst because of the revenue opportunity in its treatment drugs as well as the “potential for more drugs to advance from the integrin platform in the future.”

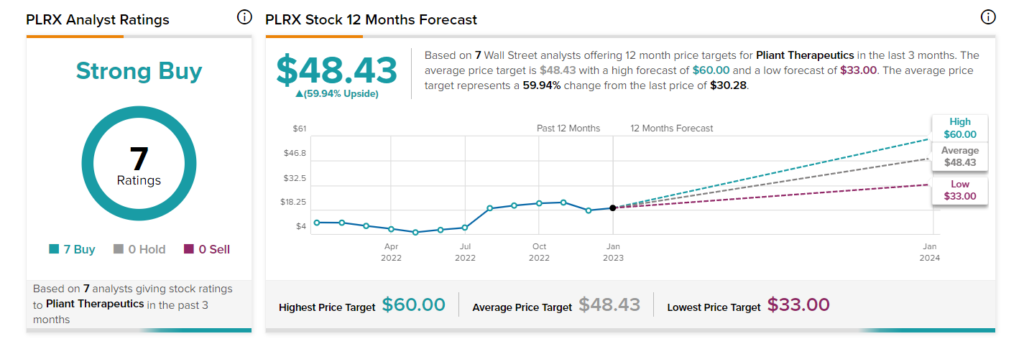

Turning to Wall Street, analysts are optimistic about Pliant and have a Strong Buy consensus rating based on seven unanimous Buys. The average price target of $48.43 implies 59.94% upside potential. Over the past six months, the stock has rallied more than 76%.

Join our Webinar to learn how TipRanks promotes Wall Street transparency