Shares of the home goods retailer Bed Bath & Beyond (NASDAQ: BBBY) are down significantly today after the company announced plans to sell more shares to raise money while looking to save money by closing stores and cutting its staff. In addition, BBBY’s preliminary Q2-2022 results are disappointing.

Bed Bath & Beyond claims to have secured over $500 million in financing and plans to issue no more than 12 million shares to help repay its long-term obligations, which stood at roughly $1.4 billion as of its last report.

Regarding cost-cutting, BBBY intends to shut down 150 stores and let go of 20% of its staff. The retailer believes that it can reduce costs by $250 million in this fiscal year. In the process, however, same-store sales are expected to drop 20% this year.

In addition, the company’s preliminary sales results of $1.45 billion (for the three-month period ended four days ago) came in about 3.5% lower than the expectations of $1.5 billion and fell 25% year-over-year. Moreover, its free cash flow will come in at -$325 million in Q2.

Shares of BBBY stock are currently down about 23.5%.

Should You Avoid BBBY Stock? Analysts Say Yes

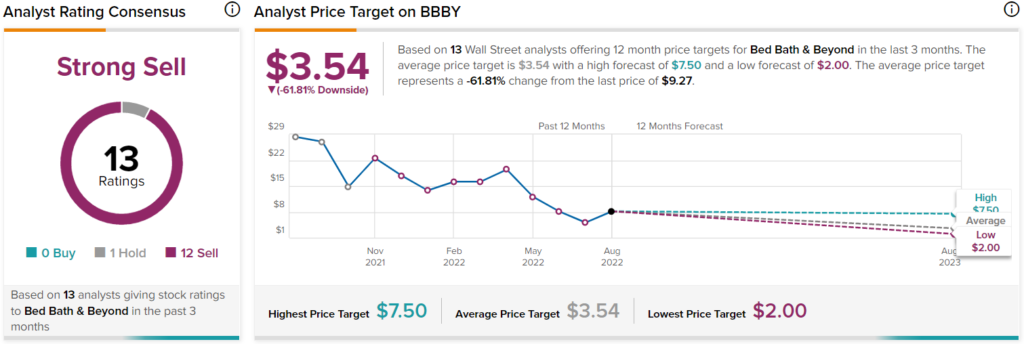

Turning to Wall Street, Bed Bath & Beyond stocks earns a Strong Sell consensus rating based on zero Buys, one Hold, and 12 Sell ratings assigned in the past three months. The average BBBY stock price prediction of $3.54 implies 61.8% downside potential.

Conclusion: Things Aren’t Looking Good for BBBY Stock

Things are not looking good for Bed Bath & Beyond. The stock is still up roughly 90% in the past month alone, while the company itself is performing poorly, and analysts think the stock has much lower to go.

With so much uncertainty surrounding the stock, it’s likely best to be avoided. However, it will be interesting to see if the company can pull off its cost-saving plans and turn around the sinking ship.

Questions or Comments about the article? Write to editor@tipranks.com