Shares of Aridis Pharmaceuticals (NASDAQ:ARDS) tumbled almost 30% on September 26 and are trading another 30% lower in today’s pre-market session. Yesterday, the company announced a proposed public stock offering.

The company did not disclose additional details on the size or terms of the offering. However, it stated that the offering is subject to market conditions, and there is no assurance if or when the offering will be completed.

The company plans to utilize the net proceeds from the offering for clinical development of its product candidates, working capital as well as other general corporate purposes.

Headquartered in the U.S., Aridis Pharmaceuticals, Inc. is a biopharmaceutical company that is engaged in the discovery and development of novel anti-infective therapies and targeted immunotherapy using fully human monoclonal antibodies, or mAbs, to treat life-threatening infections.

Wall Street’s Take on Aridis Pharmaceuticals

As per TipRanks, analysts are cautiously optimistic about the stock and have a Moderate Buy consensus rating, which is based on one Buy and one Hold. Aridis Pharmaceuticals’ average price forecast of $19 implies a whopping 2134.51% upside potential.

The company has lost more than three-fourths of its market capitalization over the past year.

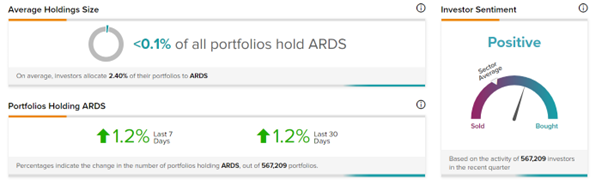

Interestingly, TipRanks’ Stock Investors tool shows that 1.2% of investors on TipRanks increased their exposure to ARDS stock over the past 30 days. This is perhaps the result of high short-selling interest in the stock.

Read full Disclosure