Streaming giant Netflix (NASDAQ:NFLX) is ramping up its efforts to launch its ad-supported streaming plans, which may be launched on November 1. As per a WSJ report, some advertisers have said that Netflix may charge roughly $65 for every 1,000 viewers. This represents a premium compared to other streaming platforms, the report said.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Netflix and its technology partner Microsoft (NASDAQ:MSFT) met with some ad buyers last week to discuss the details of the plans, which were labeled as “premium” by advertisers. The buyers are surprised by Netflix’s premium charges as it is the first time the platform will stream advertisements and the outcome is unknown.

Moreover, Netflix is demanding a year-long upfront commitment from buyers. The cost per thousand (CPM) metric is used by advertisers to denote the price paid for every 1,000 advertisement impressions or ad views.

Interestingly, Netflix is planning to cap the annual advertising spend on its platform at $20 million. This will ensure that viewers are not overwhelmed by the same advertisements and same brands very often, the advertisers stated.

Notably, Netflix is also offering buyers targeted advertising. For example, slots for advertising in the top 10 U.S. shows on Netflix or targeting specific genre-watching audiences or country-specific advertising.

While Netflix is looking to launch a cheaper ad-support subscription plan for viewers to attract higher memberships, it is looking to earn big dollars from advertisers. The company has also poached two top executives from social media site Snap Inc. (SNAP) to push its ad-tiered business.

What Is the Prediction for Netflix Stock?

Netflix is undergoing strategic changes to make its streaming platform more attractive and earn big bucks. However, for now, analysts remain on the sidelines until more clarity is achieved on the company’s ad-tiered business.

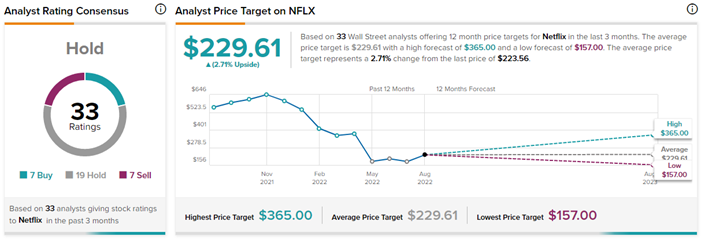

On TipRanks, NFLX stock has a Hold consensus rating based on seven Buys, 19 Holds, and seven Sells. Netflix’s average price prediction of $229.61 implies a modest 2.7% upside to current levels. Meanwhile, the stock has lost a whopping 62.6% so far this year.

Ending Thoughts

After facing two consecutive quarters of subscriber losses, Netflix is trying its hands at ad-tiered subscription plans to attract more memberships. However, Netflix is seeking to earn higher revenue from advertisers to stream their advertisements. For now, it remains to be seen if buyers will accept Netflix’s premium offerings or settle for cheaper options.

Read full Disclosure