Guess (NYSE:GES) delivered better-than-expected results for the fiscal first quarter, driven by strength in its international business. Moreover, the American clothing company raised its quarterly dividend by 33% to $0.3 per share from the $0.225 paid earlier.

The company delivered an adjusted loss of $0.07 per share in Q1 compared with adjusted earnings of $0.24 per share in the last year’s quarter. However, the reported figure surpassed the analysts’ expectations of a loss of $0.28 per share.

Furthermore, revenues declined 4% year-over-year to $569.8 million but outpaced consensus estimates of $555.6 million. The decline was due to lower demand in Americas Retail, Americas Wholesale, and Licensing units, partly offset by continued momentum in the global e-commerce business.

Meanwhile, GES reported Q1 inventories of $529 million, up 9% year-over-year. The increase was due to the company’s strategy to make early inventory investments to counter delays caused by supply chain disruptions. However, Guess hopes to have 10% fewer inventories at the end of the fiscal year in 2024.

Financial Outlook

GES increased the forecasts for FY24. It anticipates a 2% to 4% increase in revenues and adjusted profits per share of between $2.6 and $2.9 per share. Previously, the business forecasted revenue growth of 1% to 3% and adjusted EPS of $2.45 to $2.80.

Additionally, the company expects net revenues in the second quarter to remain flat or decline 1.5% year-over-year, with adjusted earnings anticipated to be between $0.35 and $0.42 per share.

Is GES Stock a Buy?

Intense competition and changing consumer preferences in the apparel business remain key headwinds for Guess. Also, the continued inflationary pressure has impacted overall consumer spending.

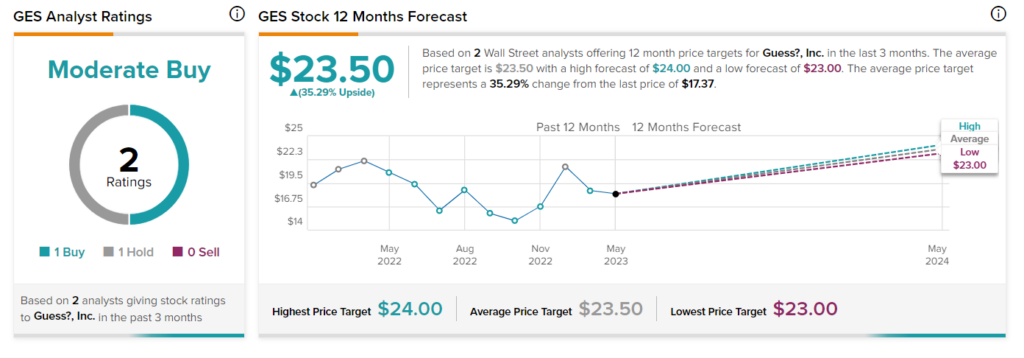

Overall, the stock has a Moderate Buy consensus rating based on one Buy and one Hold. The average Guess price target of $23.50 implies 35.3% upside potential from current levels. GES stock is down 17% so far in 2023.