One of Zentalis Pharmaceuticals’ (NASDAQ:ZNTL) major corporate insiders engaged in a huge insider buy transaction yesterday. The clinical-stage biopharmaceutical company engages in developing small-molecule therapeutics for cancer patients.

As per the SEC filing, Matrix Capital Management Company, L.P., owner of more than 10% of ZNTL stock, bought 4.76 million shares of the company on June 20 for a total consideration of $107.9 million. The total value of its holdings in the stock now stands at about $385.57 million.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

ZNTL’s Secondary Offering of Common Stock

It is worth mentioning that Matrix Capital bought shares as part of the company’s underwritten offering of more than 11 million shares at a price of $22.66 per share.

ZNTL plans to use the net proceeds to fund ongoing and planned clinical trials and other general corporate purposes. Furthermore, the company assured that, based on the recent capital raise and its existing capital balance, Zentalis will have sufficient funds to cover its operating expenses and capital expenditure needs until 2026.

Is ZNTL a Good Stock to Buy?

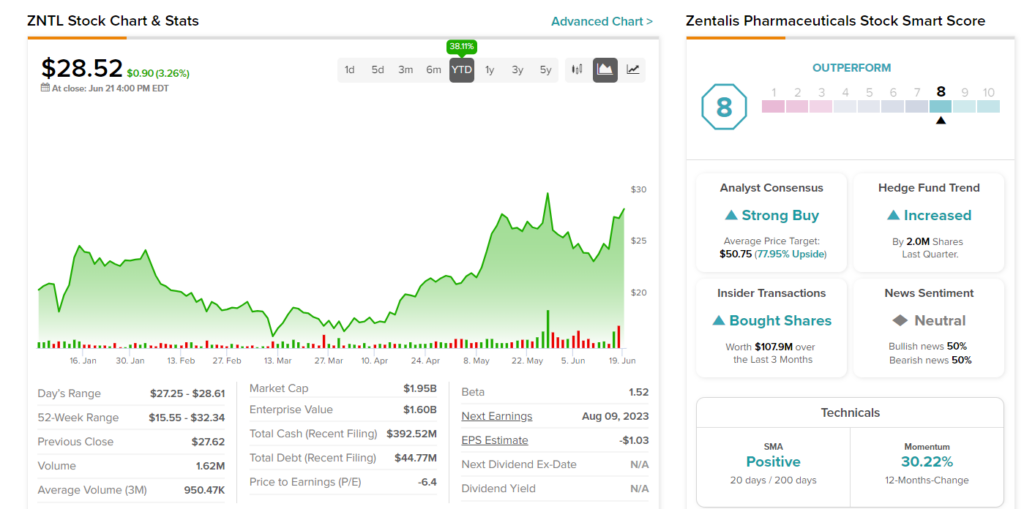

ZNTL stock has gained over 38% so far in 2023. Last month, the company released a positive update regarding the phase 1b trial evaluating azenosertib as part of a combination therapy alongside chemotherapy for the treatment of patients with platinum-resistant ovarian cancer.

Furthermore, Zentalis plans to start the phase 3 trial of azenosertib by 2024 and is collaborating with Roche and Foundation Medicine for its advancement. These positive developments bode well for the company’s long-term growth. These encouraging advancements are expected to have a positive impact on the company’s future growth

Overall, ZNTL stock has a Strong Buy consensus rating on TipRanks based on eight unanimous Buy recommendations. The average price target of $50.75 implies a 78% upside potential.

Supporting the insiders’ stance, hedge funds have also increased their holdings of the stock. In the last quarter, hedge funds bought 2 million shares of ZNTL. Overall, the stock scores a Smart Score of eight on TipRanks, pointing to its potential to outperform the market average.